Walking with You

Every Step of the Way

Every Step of the Way

PHILOSOPHY

Your Life Goals,

Our Priority.

Our Priority.

Life is complex. Your financial life, even more so. Providend helps you manage your wealth and make the right financial decision, all revolving around your life priorities. So you can focus on things that matter.

Independent.

Honest. Competent.

Honest. Competent.

We are paid only by our clients, and all product commissions are rebated back to them. Providend is the first fee-only wealth advisory firm in Singapore, where only our clients’ interests stay at the heart of our service.

As Featured On

Wealth Solutions

Wealth

Management

Management

Your life goals come first in the solutions we offer. Because money becomes true wealth when guided by a strong purpose.

Investment

Management

Management

Your money should be invested responsibly, not in ambiguity.

Risk-Mitigation

Planning

Planning

Your insurance plan should give you life protection in the case of unfortunate events and not be used as a savings tool.

Estate

Planning

Planning

Your legacy should be passed on to your loved ones as you intended, with a true peace of mind.

INSIGHTS

Most Read

Our team of experts at Providend frequently shares insights on recent financial happenings and how to manage your wealth better.

Client Case Study: At 40, Are You on Track to Retirement?

Singapore Budget 2023:

Highlights on Personal Finance

Highlights on Personal Finance

Why Buy Term and Invest the Rest Is Not the Whole Story

Can You Still Buy Insurance if You Have Medical Conditions?

Wealth Planning for Your Child’s

Tertiary Education (Part 1) – Setting a Financial Goal

Tertiary Education (Part 1) – Setting a Financial Goal

Should You Buy Retirement Income Products?

Drawing Down Your Assets vs Making Them Last Forever

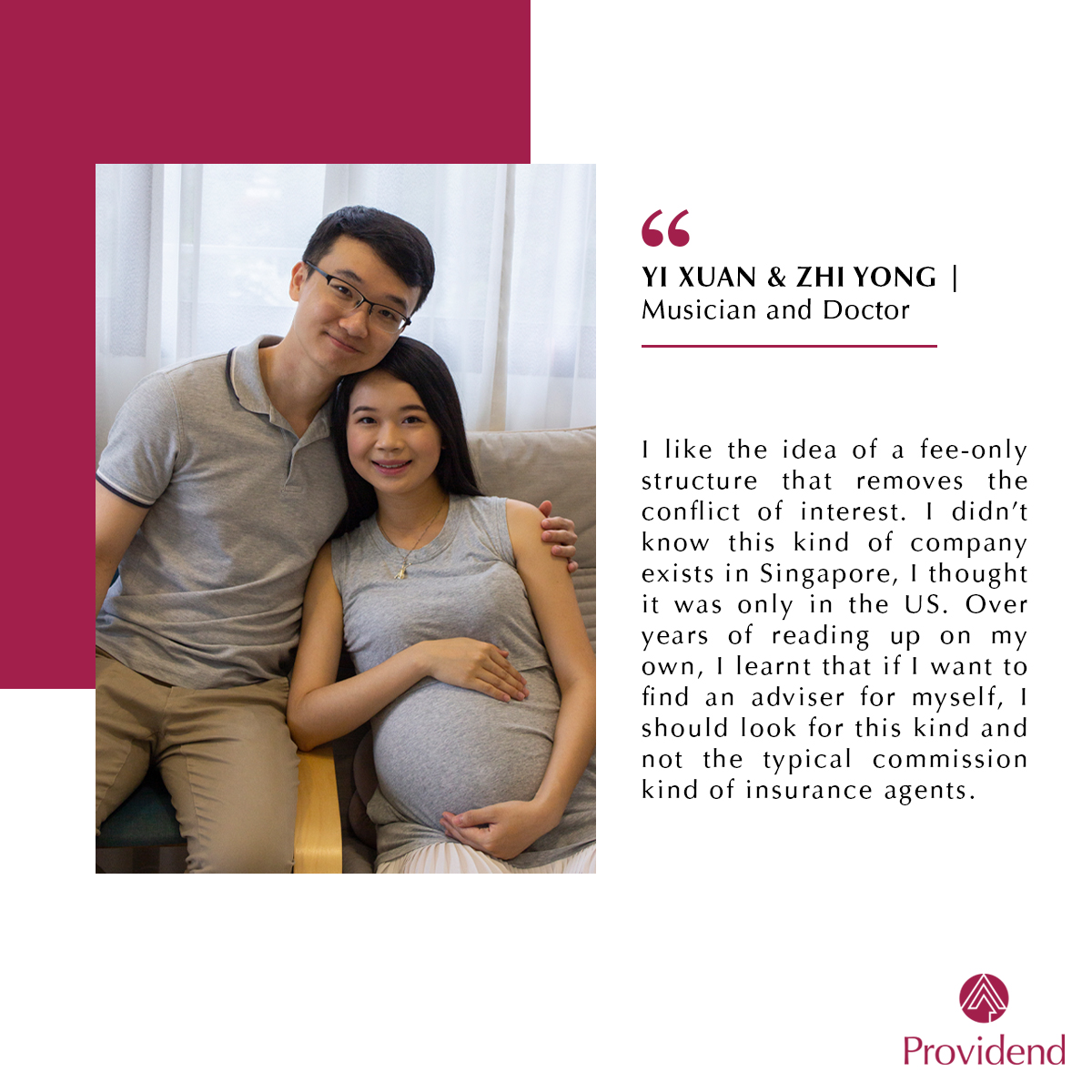

CLIENTS’ REVIEWS

Fee-Only Wealth Advisory,

Our Only Way Forward.

Our Only Way Forward.