As a fee-only retirement financial advisory firm, we have always prided ourselves to be able to give the most honest, independent and competent advice to our clients without having to struggle between what is right for them and what is best for our own pockets. However, for the past 4 years, we have been struggling with something else: The possibility that actively-managed unit trusts cannot beat the market. What this means is that funds will deliver poor returns, many of our clients’ financial goals may not be achieved and many of their dreams for themselves and their children will be broken. If this is true, we should not continue to use these funds to execute our investment strategy. But first, is there truth to this claim?

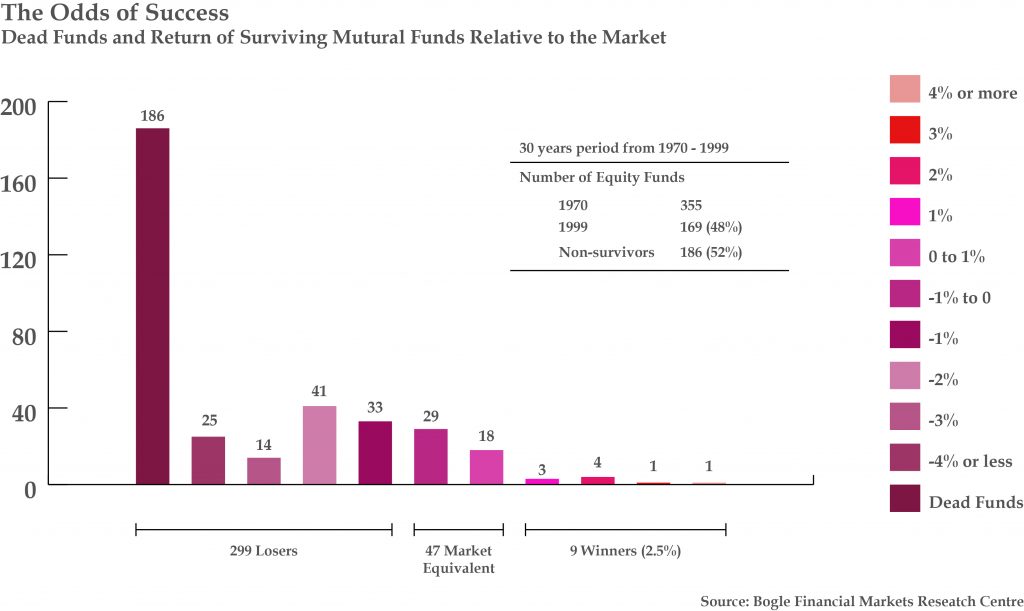

Diagram 1 show one of the many pieces of research showing that most actively managed fund cannot beat the market index. 5 years later when 800 US fund managers ranked in order of their performance, they show no consistency in performance. Top managers between the years 1995 to 1999 could not repeat their stellar performance again in the years of 2000 to 2004. Space constraints only allow me to show 2 studies done in the US, arguably the biggest financial markets in the world. But we have many other kinds of research done in other developed markets with similar results.

Diagram 1

The conclusion of these studies is clear: Most active fund managers cannot beat the market. For those that do, they cannot beat it consistently. There are many reasons why this is so but let me just list down a few:

Expenses

In reality, more fund managers could have beaten the market if not for the cost. After subtracting all those management fees, brokerage commissions associated with trading, all those sales charges, operating costs, it will be hard for these fund managers to outperform the market. The irony of the actively-managed fund is that in order to perform, they will need to hire very smart people to try and pick the right stock, choose the right time, read the right charts, execute the right trades so that they can beat their competitor down on the next street. You will also need to motivate financial salespeople to sell your funds. And guess what? Smart people are expensive to hire and good salespeople will want good commissions, and thus expenses go up and eat into returns.

The Stress On Fund Managers To Perform

At the end of every year, every fund management company will want to win the top position in a fund award ceremony. Champagnes are popped and accolades are given. The next day, advertisements are out on every major media bragging about the achievements. This “resume” will then be used by the fund houses salespeople to get more financial advisers, wealth managers to sell the funds to investors. In short, awards mean more assets under management. Unfortunately, many of these awards are based on short term performances like 1 year and 3 years and as a result, managers may make short term decision at the expense of long-term performances.

The Problem With Active Management

In order to beat the market, fund managers must pick the right stocks from the entire market. It is a risky game and one that can work for you or against you. In addition, because the stock market is a zero-sum game, you need to beat the competition. Your fund managers must face top investors like George Soros, Warren Buffett, and many others. How often can fund managers win? Sometimes, not all the time. Even very smart people cannot make the right decision all the time. For those that make more right decisions than the wrong ones, they get headhunted by the competition next door. As a result: Inconsistency in fund performance.

So what options do investors have? Passive instruments such as low expense index funds and ETFs could be the solution. These instruments do not attempt to beat the market. Instead, it replicates the market and only hopes to achieve a market return. But if most funds cannot beat the market, and if you are getting market returns, you are getting much better returns.

Have you ever dreamt of having all the top investors working for you? Dream no more. By investing in the entire market through these passive instruments, you get just that: The aggregate performance of all these investors, including the better active managers in the world. Who are the proponents of passive instruments? You have Benjamin Graham (the teacher of Warren Buffett and the so-called founder of the profession of financial analysis), John Bogle (founder and former CEO of Vanguard), Eugene Fama (father of modern finance), just to name a few and many other Nobel Laureates. The greatest investor of all-time Warren Buffett himself says that most investors are better off investing into an index fund.

Our struggle started in 2004 when as much as we believe in the concept of index investing, we do not have many of these instruments available in Singapore. There are less than 20 ETFs (and mainly investing only into emerging markets) and only a handful of index funds available to investors in Singapore. Private Banks may have access to these instruments out of Singapore but instead, structured products are usually recommended to clients. Why is this so? Some years back, I was having lunch with Mr Jon Robinson, the former Managing Director of Vanguard Investments Singapore. I asked him why he is not bringing the slew of index funds that Vanguard is so well known for to Singapore. His answer was simple and straightforward: “There is no demand”. What he really meant was that there is no demand amongst the distributors. One of the biggest advantages of passive instruments is that of low cost. Low cost means no or low front end sales charges and management fees. This means low front end commissions and trailers for financial salespeople and as such, the lack of demand. In our commission-driven wealth management industry, it may be some time before we see more financial advisers embrace the use of passive instruments. I hope I am wrong.

Today, because of regulatory restrictions, we can only recommend our portfolios which consist mainly of ETFs to our high net worth clients. To be fair, active managers can still do better in emerging markets where it is not so efficient and the use of passive instruments may not be suitable. Unfortunately, for the rest of our clients who do not meet the “Accredited Investor” definition of having SGD2 million net worth and SGD300,000 income in the preceding 12 months, we continue to use active-managed funds. For these clients, we have to regularly review the performance of these funds, interview the managers, check the movements of their key managers just so that we can help our clients reach their target returns needed for their financial objectives. We are not banking on achieving above-market returns but simply on the required returns of our clients. So far this has worked but investors may be paying too much to achieve the same results from a passively-managed fund. But with the current regulatory constraints, this is the best solution.

5 years ago, when we said that mixing commissions with advice will give rise to a potential conflict of interest, the wealth management and financial planning industry were very upset with us. 4 years ago when we single-mindedly advocated the use of low-cost term insurance instead of the high commission whole life plans, the insurance industry was fuming mad. Today as I write this article, I fear I may offend the asset management industry. But seriously, if you don’t belong to the industry and you are our client with your retirement goal and children’s education objectives, what would you like me to say?

The writer, Christopher Tan, is Chief Executive Officer of Providend, a Fee-only Wealth Advisory Firm. Besides being financially trained, he is also an Associate Certified Coach with the International Coach Federation. The edited version has been published in The Sunday Times on 13-14 September 2008.

For more related resources, check out:

1. Making A Name Through Ethical Practices

2. Active vs Passive vs Evidence-Based Investing

3. Thoughts & Reflections From Hong Kong: Why Is Investing So Difficult?

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.