Some investors may have reservations about investing in a fund that is denominated in a currency that is not their home currency.

For most of our clients, they hold equity and bond funds that are denominated in both SGD as well as USD.

You may wonder whether there are some inherent risks if the USD weakens and how that will affect your fund.

In today’s article, I will explain why you should worry less about the currency your fund is denominated in. I will also show why avoiding a particular weak currency may be rather daunting for you to manage on an individual level.

I will also explain why it is recommended to invest in a bond fund that is hedged to the currency you would use for your spending.

Currency Can Only Depreciate Against Another Currency Pair

The first thing to understand is that a currency is always quoted in a pair. This is mainly because currencies usually are compared to one another.

So, if you are worried about USD weakening, a more appropriate question is which currency are you worried that the USD is weakened against.

In 2019 USD weakens against the SGD. In the same year, the USD was stronger than the AUD.

The degree or magnitude of strength and weakness between the USD and different currencies would differ as well.

In 2009, the USD weaken 22.5% versus the AUD but only weaken 2.6% against the SGD. The weakening effect may be a bigger deal if you are an Australian businessman whose main market is in the United States.

The Denominated Currency is Like a Middleman between Your Home Currency and the Fund’s Holdings

The currency that your fund is denominated in can be described as an intermediate currency. Think of that currency as a middleman between two parties.

The two parties are:

- The currency you are spending your money in. Typically, this is your home currency such as SGD or AUD for example.

- The currency of the underlying stocks the fund invested in. For example, the MSCI All Country World Index, which is a basket of global stocks, invest in Nestle, which is in Swiss Franc, and Alibaba, which is in Renminbi

The USD negotiates between the SGD and the Swiss Franc (CHF) and Renminbi (RMB).

For example, suppose the USD weakens by 2% against both SGD and the RMB. Suppose also, the fund returns 0% during the period you are invested.

When we first look at the fund angle, which is denominated in USD, the RMB returns would look much higher, due to the USD weakening. If the fund only contains Alibaba, the fund’s performance would like much brighter.

Now, if we, as a Singapore investor, sell the USD denominated fund, there will be a currency exchange. We will get USD dollars. Since the USD weakens 2% against the SGD, the amount that we get is worth less than when we first invested.

Net-net, while the RMB returns are good, when the money finally reaches your hands in SGD, it ends up similar.

This relationship does not always hold. The USD could weaken against the SGD but strong against the RMB. The USD could weaken more versus the SGD while it weakens less versus the RMB.

Case Study: Investing in the MSCI All Country World Index Denominated in USD, AUD, and SGD

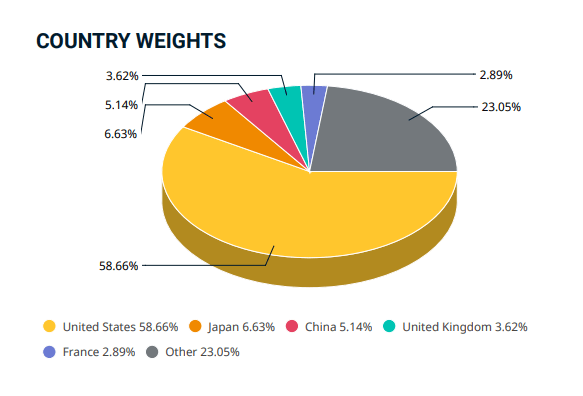

The MSCI All Country World Index is an index made up of a basket of roughly 2,984 equity companies, spanning 23 developed markets and 26 emerging markets.

Suffice to say, the MSCI All Country World’s returns are in many different currencies:

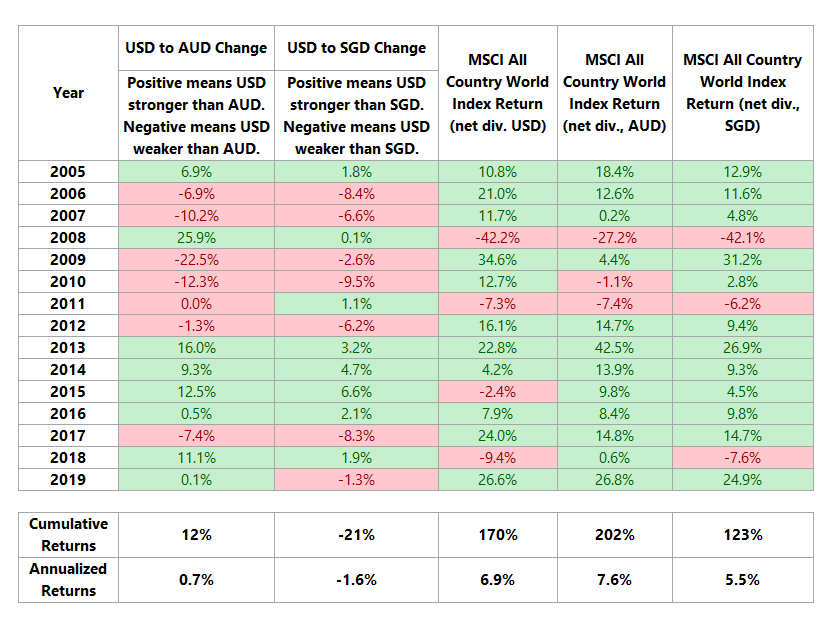

We can compare the year-to-year returns of the MSCI All Country World Index if it is denominated in USD, AUD, and SGD.

This will give you an idea of how the returns will look if you invest in the index in various denominations.

The table below shows the annual return of the index in three different currencies and the change in currencies from 2005 to 2019:

The first two column shows the USD’s strength versus the AUD and SGD. A positive number means USD is stronger while a negative number means USD is weaker.

The next three column shows the MSCI All Country World Index Returns in USD, AUD, and SGD respectively.

All three funds bought into the same stocks, in the same sector, in the same geographical divide.

The USD was weak from 2005 to 2012. After that, the USD was generally strong against both SGD and AUD.

Let us zoom into some years.

In 2009, the USD denominated index made a 34.6% return. However, in that year, the USD weaken 22.5% and 2.6% respectively versus the AUD and SGD.

The funds denominated in AUD returned only 4.4% while the SGD one returned slightly less at 31.2%.

If you own the fund in AUD, you would be very disappointed with the 4.4% return. However, think about it. If you had invested in the USD denominated fund, you would earn a 34.6% return.

But at some point, maybe at the end of that year, you must sell the fund and convert that USD back to AUD. The net result of the weaker USD means that you would have gotten back close to a 4.4% return.

Net-net things are the same.

In 2013, the USD appreciated against the AUD and SGD by 16% and 3.2% respectively. The Index returned 22.8% in USD. However, the index denominated in AUD returned 42.5% as the return is boosted by the USD’s 22.8% appreciation. The index denominated in SGD also got a 3.2% boost to finish at 26.9%.

If you sell the USD denominated fund and gotten your monies in AUD and SGD respectively, you would have gotten close to the 42.5% and 26.9% plus your principal due to the strong USD.

If you review the results year by year, you will realize that the change in currency and the difference in returns between the three funds are not exactly very, very similar. This is because there are frictions in conversion between one currency to another. For example, the conversion when you sold off your fund might not be as good compared to the currency spread the fund can get when the fund invests in their underlying stocks.

It Can be Challenging to Avoid Weak Currencies Entirely to Improve Your Investment Returns

It can be quite challenging if you wish to avoid certain currency weakness.

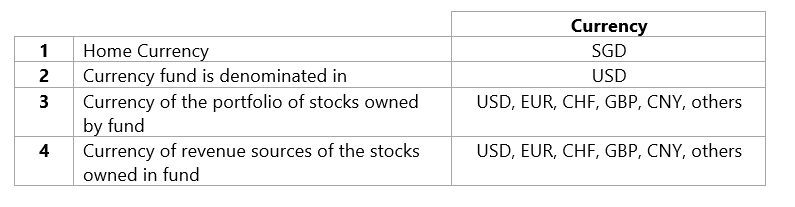

The way you can frame this problem is to look at the “stack” of currency you would need to navigate through:

You will have to control your exposure between

- The home currency and the currency the fund is denominated in

- The currency the fund is denominated in and the currency of the portfolio of stocks owned by the fund

- The currency of the portfolio of stocks and the currency of the revenue sources of the stocks the fund owns

If you believe that the USD is going to be weaker in the next 10 years, then you would need to find a fund that is not denominated in USD, which do not contain stocks whose home currency is in USD and among the stocks in the fund, you would need to ensure that their revenue sources is not mainly based on selling to the United States.

A fund manager picking individual stocks could perform this.

However, in this very globalized world, it may be quite challenging to avoid a particular weak currency 100%.

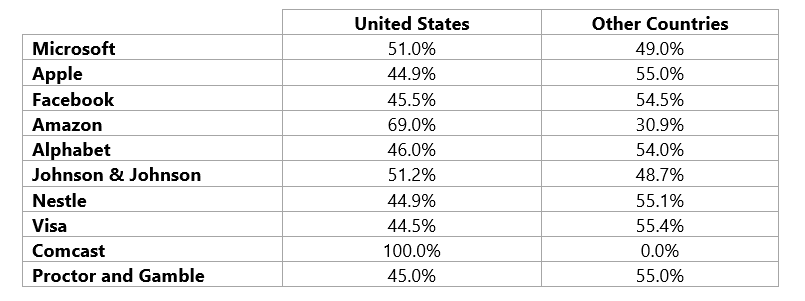

The table below lists the percentage in revenue sources derived from the United States versus other countries for some of the larger constituents of the MSCI All Country World Index:

What you can observe is that almost half of the revenue of the larger stocks in these funds come from other countries. This means that the revenue would be earned in a foreign currency.

While 60% of the index are United States companies, the USD revenue exposure might be about 30% of the entire index.

The Advantages of a Weaker Currency to Your Fund’s Investment Returns

It is not always detrimental to have a weaker currency. In fact, the countries around the world from time to time engage in an exercise to make their currency weaker, relative to one another.

Suppose China’s currency is weaker than Korea Won, this means that China’s exports are cheaper than that of Korea’s, all else being equal.

Having a weaker currency, in this case, would spur demand for China firms. With more goods and services sold, this means that their revenue and profits may be higher.

A weaker currency would prove detrimental if a country fashion itself as a wealth hub. Singapore comes to mind.

Investors looking to preserve and grow their wealth are attracted to investments in a wealth hub due mainly to the stability and strength of Singapore’s currency. If the SGD weakens, this might not be good if our priority is to ensure that we remain a wealth hub.

What You Should Focus On When Deciding the Fund You Invest in.

Let us recap the important points of what was presented:

- There is a “stack” of currency pairs that you must contend with if you invest in a fund

- A currency can weaken against one currency while it strengthens against a second currency

- There are different magnitudes of strengthening and weakness

- The currency the fund is denominated in can be seen as a middleman. What is important is your home currency and the currencies of the stocks owned by the fund

- Businesses in a globalized world earn their revenue, not in a single currency

- This will make your job to avoid certain currency weakness difficultly

- Currency weakness in a certain case may increase the demand of the underlying businesses’ products, improve their profits, and caused the stocks to appreciate at a price

What you can focus on is to decide which currency would you be using to spend in the future. For example, if you are pretty sure that you will leave Singapore to go back to Australia to retire, you should invest in an AUD denominated fund.

If you wish to retire in Singapore, then you should invest in an SGD denominated fund. If one of your children will be going to the United Kingdom to study, there are grounds for you to hold a fund that is denominated in GBP.

In this way, you minimize any slippages lost when you convert from one currency to another.

However, if you spend in SGD and you own a USD denominated fund, this is not a big problem. Eventually, what matters is SGD versus the currencies of the basket of stocks held in the fund.

By investing in a low-cost, globally diversified equity fund, you dissipate a single currency risk by holding stocks denominated in various currencies, deriving profits and revenues in various currencies.

At the end of the day, your focus should be on investing in a portfolio that allows you to capture the market returns.

Bond Funds Are Recommended to Hedge the Currency Risk

Whatever that I explained before this point applies to equities.

For bonds, it is a different matter altogether.

You may have noticed that the majority of the bond funds are hedged to certain home currencies. For example, a bond exchange-traded fund (ETF) listed on the London Stock Exchange is hedged to GBP.

If the fund is not hedged to their home currency, they tend to be hedged to popular currencies such as USD or EUR.

This is because currency tends to be the most important variable in international bonds.

Typically, the yield return of bonds is much lower when compared against the total return of equities.

Thus, if the currency fluctuates, it will easily negate the bond returns. In fact, the volatility of the currency is often greater than the volatility of the bonds.

From 2011 to 2015, currencies account for nearly half the volatility of the Bloomberg Barclays Global Aggregate Bond Index.

While over the long term, bond funds that are hedge and unhedged have similar performances (this is because the currency moves largely balanced out in the long run), in the short term the volatility could negate the bond returns.

While fund managers understand this, clients might not be able to stomach the volatility in their bond fund returns.

At Providend, the bond funds we recommend to our clients are typically hedged to SGD or USD.

This is because the majority of our clients will eventually spend their wealth in SGD.

If you are limited by what you can invest in, your alternative may be to invest in a fund that is hedged to USD. The USD is the reserve currency and the usual investment currency. It allows you to easily transit into other investments that are typically denominated in USD.

The article you have just read is part of Providend Curated Insights, a selected repository of content that we research about and reflect upon for the best recommendations to our clients.

Providend Curated Insights is narrated currently by Kyith Ng, Senior Solutions Specialist at Providend, Singapore’s First Fee-only Wealth Advisory Firm, and Chief Editor of InvestmentMoats, Singapore’s most well-read financial blog.

For more related resources, check out:

1. Keeping Faith Despite the Market Downdraft

2. Returns of a Portfolio of World Equities Through Good Times and Bad Times

3. The Importance of Liquidity in Your Investment Portfolio

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.