The trade war flared up in August as both the US and China signalled that they would impose new tariffs on imports. These tariffs did come into effect on 1st September, with the US imposing 15% tariffs on US$125bn of Chinese goods, and China imposing tariffs on US$75bn worth of US goods in return.

This predictably led to a fall in the equity markets, with the MSCI World -2.05%, MSCI Emerging Markets -4.88% and the local STI index -4.96% (in SGD). Bonds typically have a negative correlation to equities, so fixed income did well for the month as the FTSE World Government Bond 1-5yr was up 0.89% and the Bloomberg Barclays Global Aggregate Bond Index was up 2.27% (both USD hedged).

It is this negative correlation that we are counting on when we construct our portfolios with asset allocation in mind. For example, our Index+ balanced portfolio has a 60% allocation to stocks, and 40% allocation to bonds, using the funds from Dimensional Fund Advisors. In August, the portfolio fell 1%, which is a lot less than the 4.96% fall in the STI index. This is because this portfolio follows an asset allocation of 40% bonds, and 60% stocks, which takes advantage of the negative correlation between stocks and bonds to reduce the volatility of the portfolio. While 60% of the portfolio was down, 40% of the portfolio went up, and so overall the loss for the month was reduced substantially.

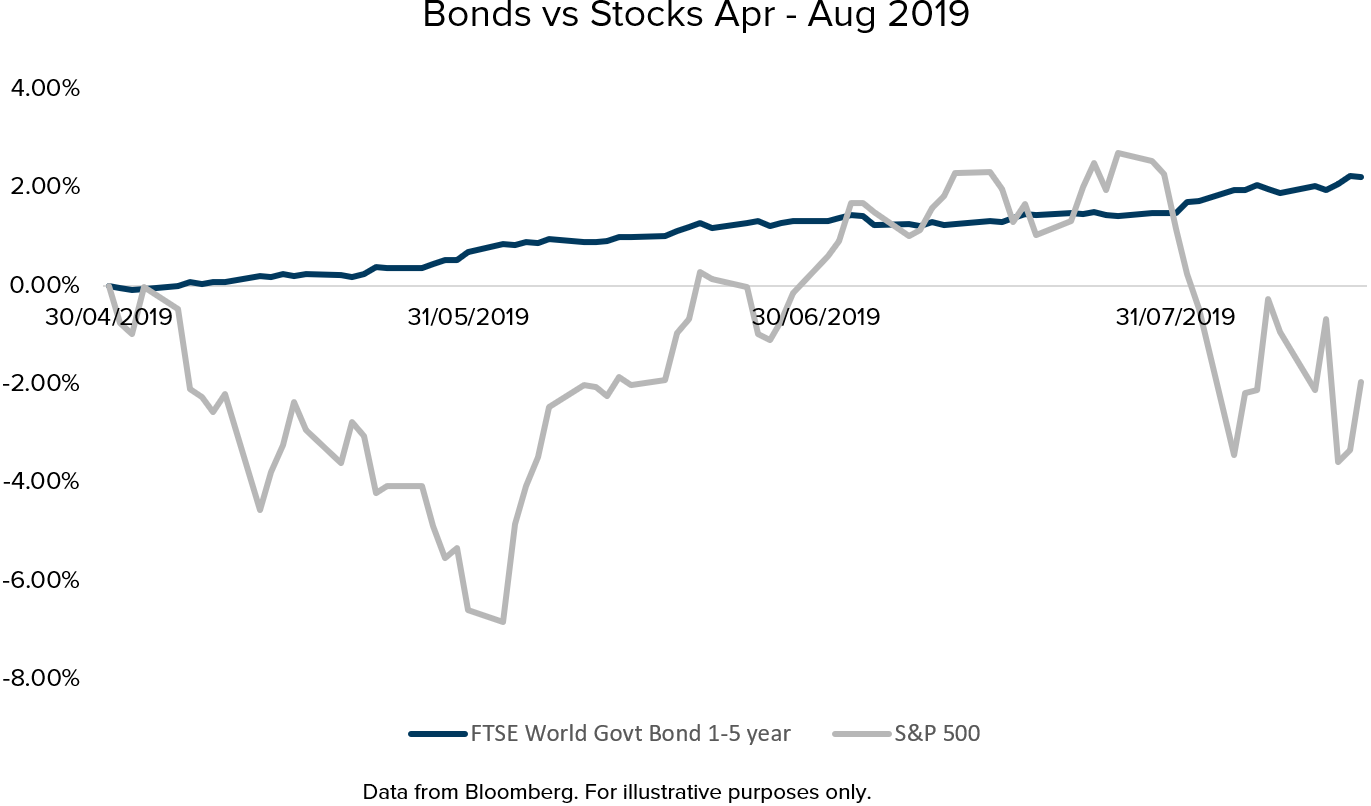

In fact, our Index+ Conservative portfolio which has 80% in bonds and 20% in stocks was up 0.05% in August, because the returns from bonds more than compensated for the big fall in stocks. The chart below highlights how bonds and stocks have done in the past few months, with bonds going up during periods where the stock market is down.

Asset allocation accounts for 90% of the variability of a portfolio’s return, according to the 1986 study by Brinson, Hood, Beebower which is one of the tenets of portfolio construction in investing. At Providend, our Client Advisers take the time to understand each client so we can get the asset allocation right for the client, putting them into the portfolios that can help them achieve their financial goals, while still suitable for their risk tolerance.

Our goal is to help keep our clients invested through the ups and downs of the market so they can capture the long-term asset class returns from bonds and equities. Instead of timing the market, which we cannot do consistently, we focus on the asset allocation so clients can invest confidently and stay invested.

As always, if you feel you would like to review your goals or discuss your asset allocation with your Client Adviser, please do not hesitate to reach out. Our Client Advisers are always there for you. Thank you.

Warmest Regards,

Solutions & Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.