Just like that, 2019 has gone by and US markets have had the best year this decade since 2013. If that sounds surprising, it’s only because of how quickly we recovered from the pain of 2018, where the S&P 500 fell 20% over the last quarter of 2018, cumulating in one of the worst Decembers in history.

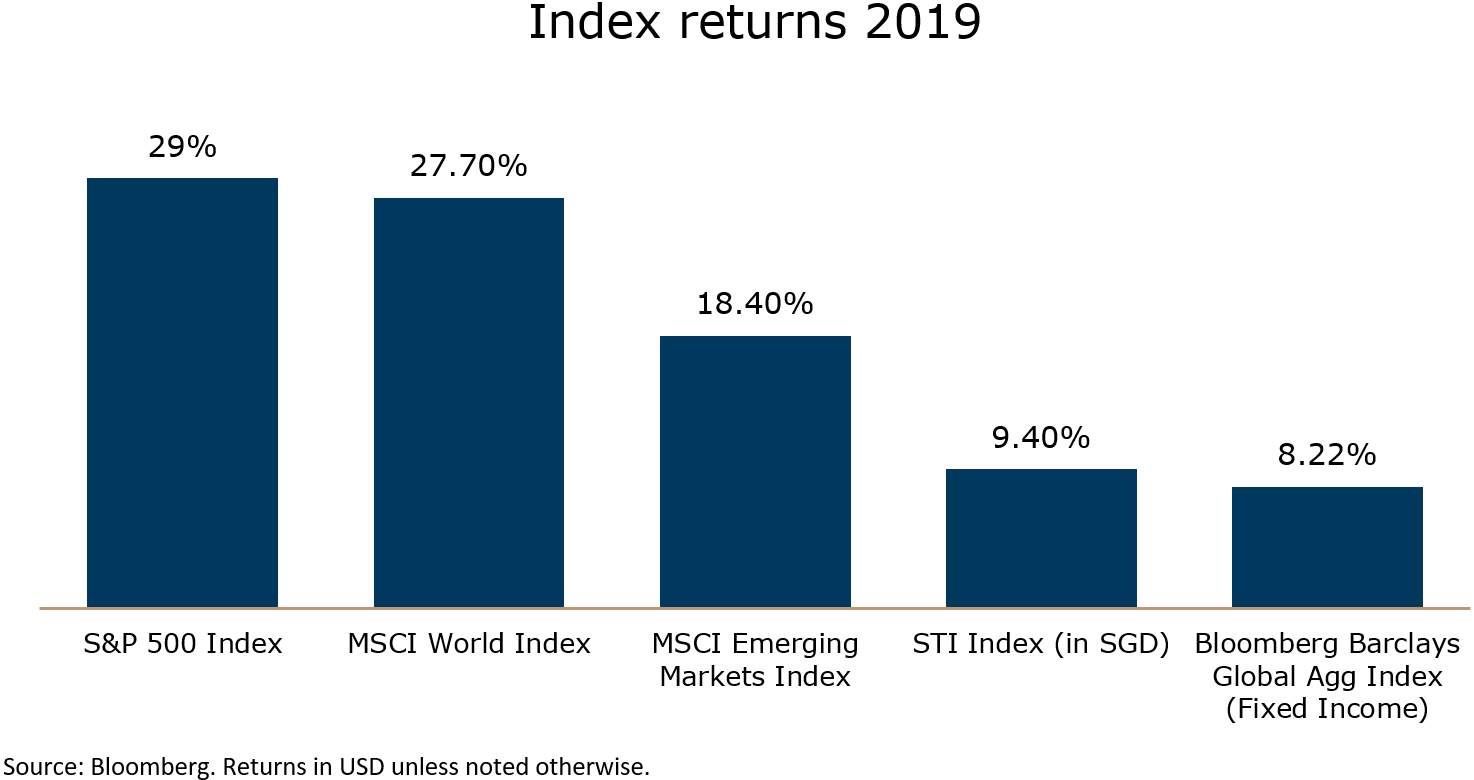

Exhibit 1

Looking at exhibit 1 above, we can see that strong US market performance lifted Global Equities as represented by the MSCI World to comparable performance, as European and Japanese equities also had a stellar year in 2019. Emerging markets recovered from a very difficult 2018 to rise 18.4% and the STI returned 9.4%. Bonds delivered equity-like returns of 8.22% over the year, marking another great year for fixed income investors.

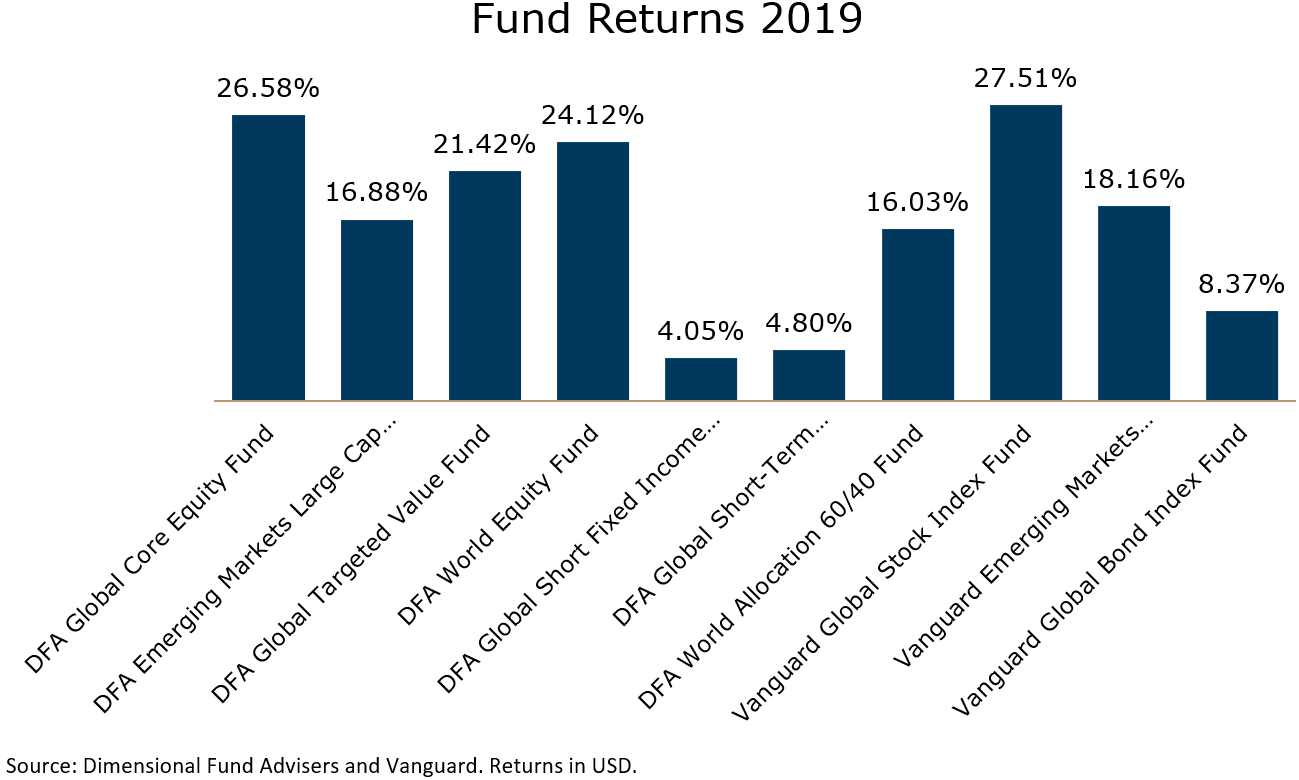

Unfortunately, we cannot invest directly in indexes, so let’s look at how the funds we invested in have done in 2019. As a refresher, most of our portfolios use either fund from Dimensional Fund Advisors(DFA) or Vanguard so we will look at the performance of those funds here.

Exhibit 2

As we can see from exhibit 2, the funds we implement our portfolios with have captured the index or market returns for 2019. Your actual portfolio returns will depend on when you invested, how you have invested (via lump sum or RSP) and your portfolio asset allocation. Your portfolios have a mix of bonds and stocks and this will determine your overall returns.

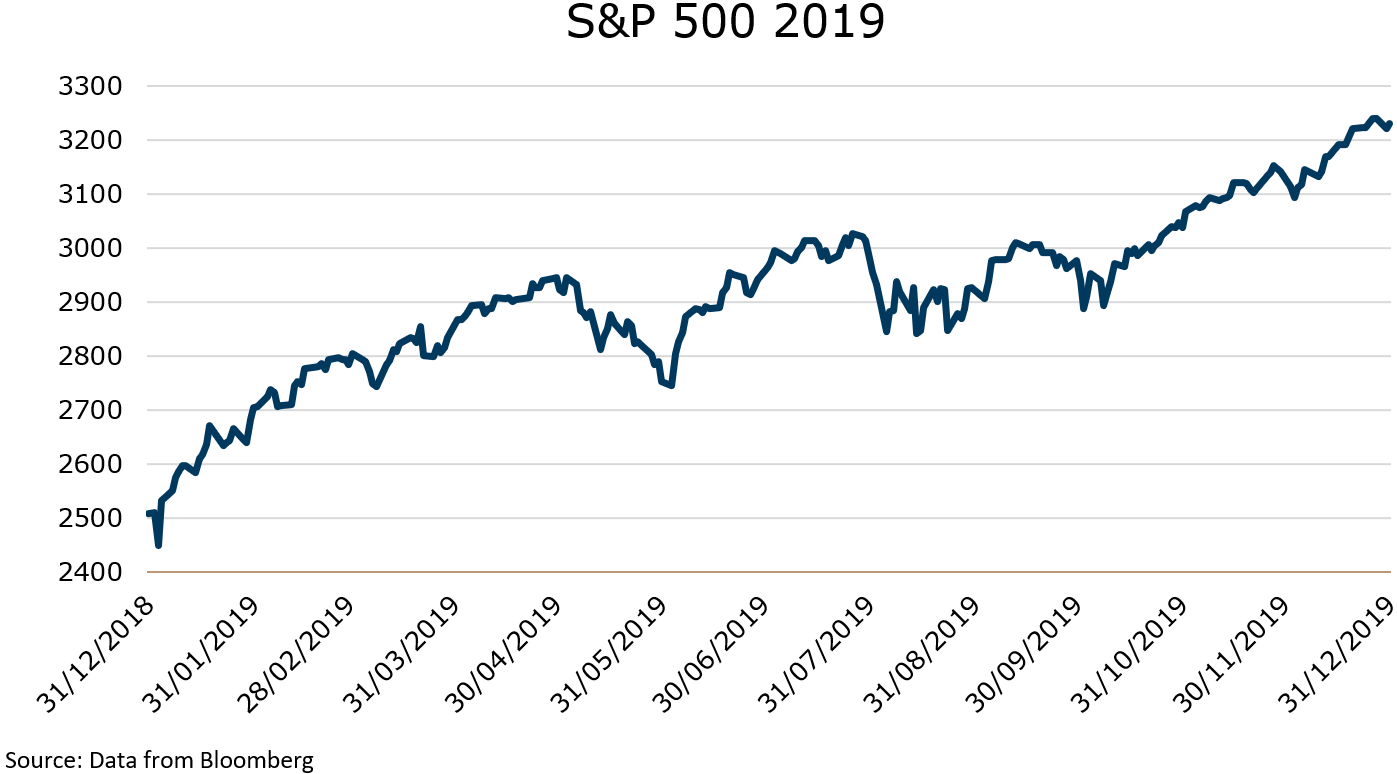

Exhibit 3

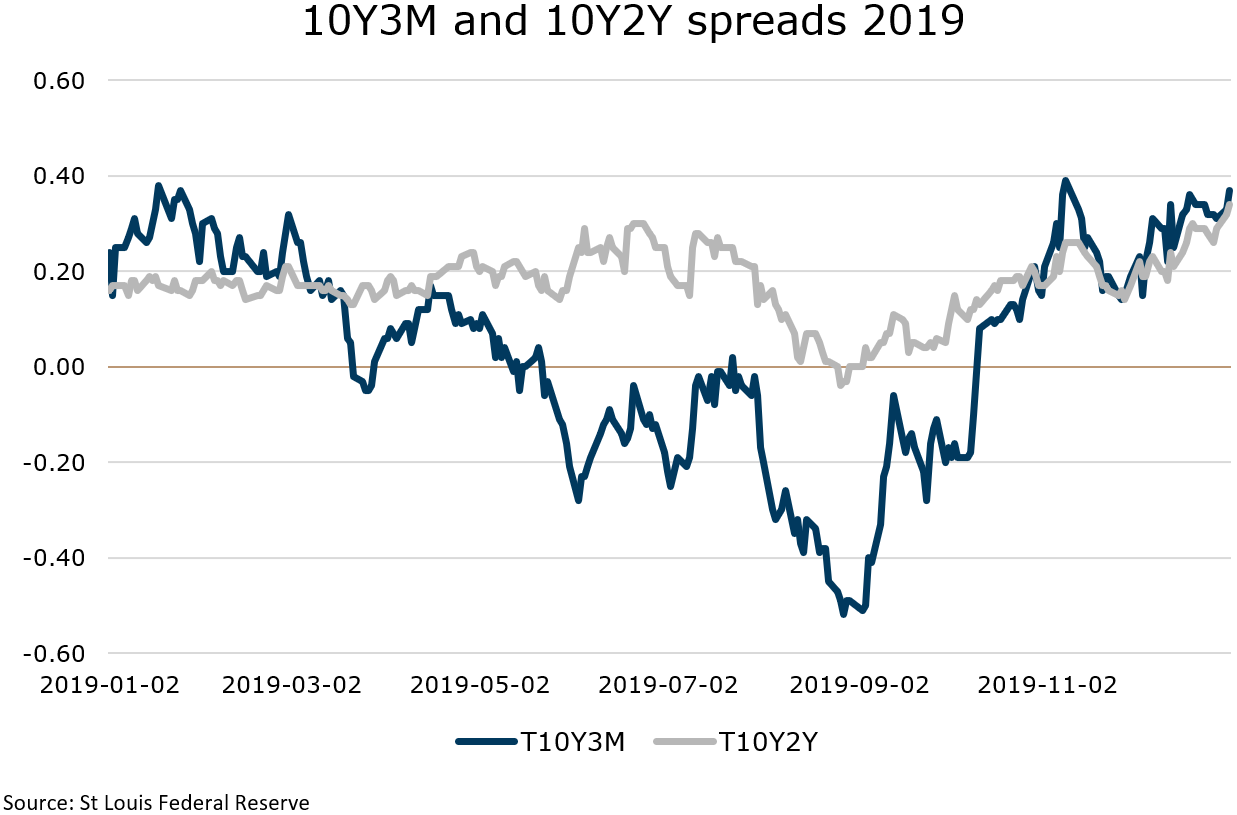

While the 29% return looks fantastic, the year was not without some major hiccups. From exhibit 3, we can see that the S&P 500 fell 7.6% from May to June and fell 6.8% from July to August. This was due to fears that the trade war between the US and China would escalate as an agreement for a trade deal proved elusive. Fears of a recession were also stoked when the 10yr/3m and 10yr/2yr spread for treasury yields went negative, causing an inversion in the yield curve which has typically preceded every US recession since 1975 (See exhibit 4 below).

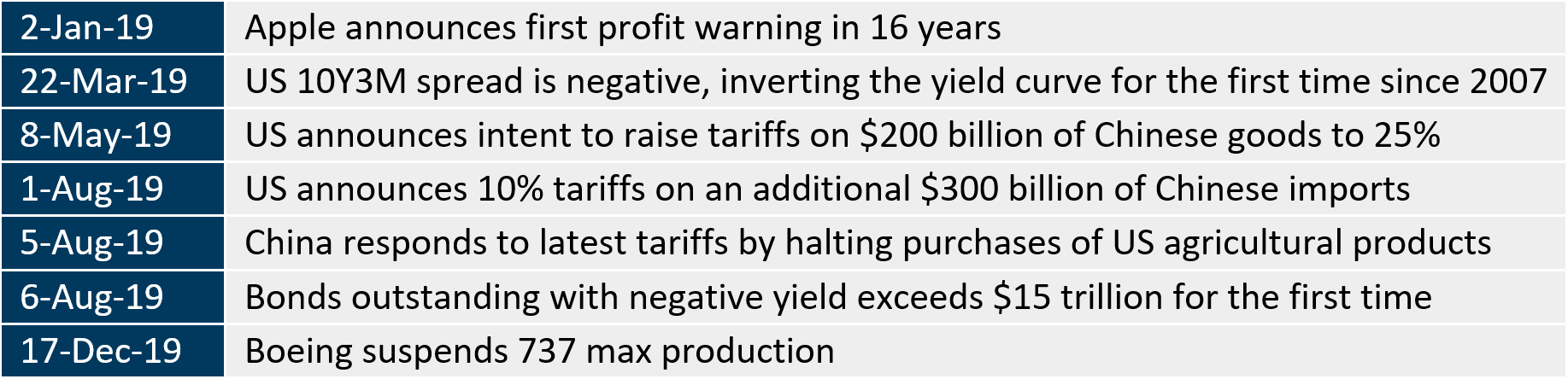

Looking back at some of the negative news in 2019, there were many periods of uncertainty and there were serious concerns about economic growth and even earnings growth of major companies (see exhibit 5). Despite this, the market still rallied to new records by the end of 2019.

Exhibit 4

Exhibit 5

What can we learn from all this headed into 2020? If there is one thing to take away, it is that there will always be uncertainty when investing. We never have perfect information on outcomes, everything is a probability. How do we ensure that our clients have a good chance of a successful investment experience? We make sure our portfolios are diversified.

We typically have more than 8,000 stocks in our portfolios implemented with Dimensional funds. This helps with the uncertainty, as that keeps the chance that any one position doing badly will impact the portfolio in an outsized way. Assuming that all 8,000 stocks are evenly allocated across the portfolio, each position will be 0.0125% of the portfolio. A 20% fall in price in one of the stocks will only impact the portfolio by 0.0025%, or $25 per $1,000,000 invested.

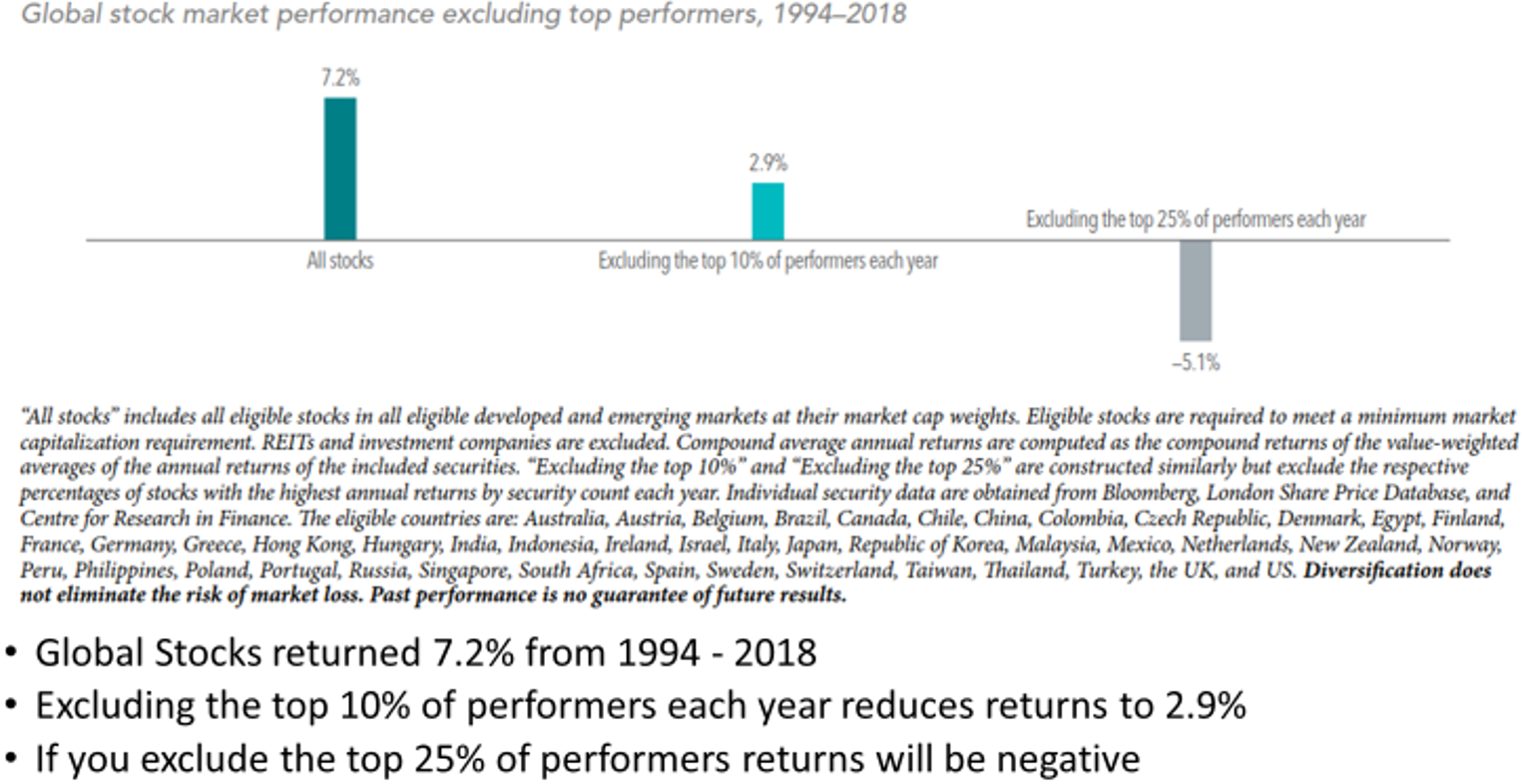

Diversification also helps to make sure you capture the best returns as it helps you hold the best performing stocks for any time period. Uncertainty works both ways, there can also be uncertainty around good news. Will a new product launch revitalise a company’s business? Nobody can be 100% certain, but successful new products will lead to higher profits and ultimately better shareholder returns. This is important because the data shows that the best performing stocks have an outsized impact on returns in any given year (see exhibit 6 below).

Exhibit 6

Using a 2019 example, Apple and Microsoft accounted for 14.8% of the S&P 500 Index’s return. Not having these 2 companies in your portfolio would have resulted in 4.35% less performance if you had held the other 498 S&P 500 stocks instead. Would this have been expected at the end of 2018? Maybe not as Apple had delivered a return of -6.8% in 2018. Staying diversified keeps our portfolios invested in the best performers at any period.

This is but one of the ways we build our portfolios to give our clients a successful investment experience. Do get in touch with your Client Adviser if you’d like to hear more about how we invest for you! One thing is for certain, there will be more uncertainties in the coming year, but as always, we are here for you to help guide you to achieve your financial goals with our honest, independent and competent advice.

Thank you for your continued trust and support, and wishing you a Happy New Year in 2020, and a prosperous year of the Rat!

Note: Parts of this article may have appeared in MoneyOwl’s 2019 Market Review, and have been used with permission from MoneyOwl Pte Ltd.

Warmest Regards,

Solutions & Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.