We are writing our usual end of month review a little earlier to give you an update on the markets as recent trends of the COVID-19 disease caused by the SARS-COV-2 (Severe Acute Respiratory Coronavirus 2) has started to be reflected in market prices for stocks and bonds.

With the increased number of cases in South Korea, Japan, Italy and across Europe, the S&P 500 has posted six consecutive negative closes to notch its fastest correction from its peak reached on Feb 19th, falling 12% at the close on Feb 27th. The MSCI World index fell 10% over the same period as equities in Europe (-10%) and Japan (-6%) also fell due to concerns that the global economy will be disrupted by the spread of the virus. A fall of > 10% is referred to as a correction, and this does happen once every few years, with the most recent one in Oct – Dec 2018.

What are the main concerns for the economy right now?

- Supply chain disruption. Perhaps the best example of this is Apple coming out to say that they are unlikely to meet their revenue projections as they are facing uncertainties of restarting iPhone production in China. Due to the various quarantines in different parts of China, many migrant workers that went home over the Lunar New Year are not yet able to return to their places of work. Even if they did, in some areas they would have to go through a 14-day quarantine before being allowed back in their workplace. This has delayed the resumption of production at many factories in China, impacting the global supply chains of not just Apple, but various other MNCs that depend on China for finished or intermediate products. Car manufacturers such as Nissan has to cut production at their plants in Japan as they are unable to source required components from China due to the delays.

- Service industries particularly travel and hospitality. Airline stocks in Europe and Asia have taken a beating as travel restrictions reduce demand for air travel. For example, SIA recently announced a reduction in their flights across their network due to lower demand as travellers postpone non-essential travel.

- Unexpected disruption to globalisation as the virus spreads. While the supply chains in China are the largest concern, the spread of the virus to South Korea has also shown how it can cause economic impact elsewhere. Samsung was forced to close a smartphone factory in South Korea over the weekend as one of the workers there was diagnosed with COVID-19. South Korea, Japan and manufacturing across Asia and in Europe is at risk of being disrupted if the virus spreads rapidly.

Of more immediate concern to clients will be how all this is likely to impact our portfolios. Let’s look at a few key points to remind ourselves to stay invested for the long term.

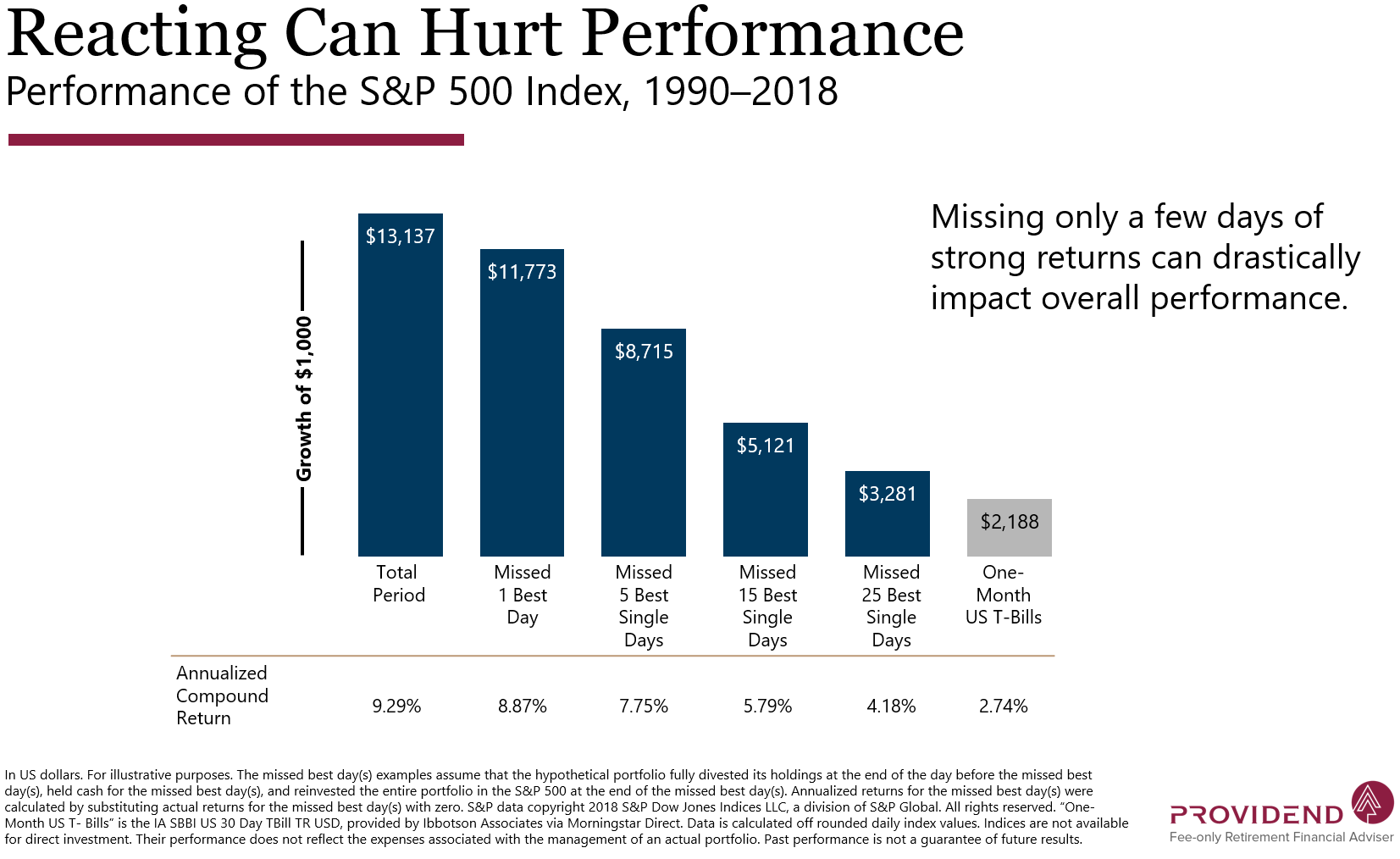

Exhibit 1

Markets are efficient. The recent fall in stocks reflects the market pricing in the new information, that the economic impact from COVID-19 is greater than initially expected. Given how quickly information is priced into the market, it is very difficult to time when the market will reach a bottom, making it rather unproductive to think about selling out and buying back later. Rather, focus on the fact that your diversified portfolio and long investment horizon allows you to avoid locking in any losses. You can ride out the volatility as you know that your portfolio is comprised of almost all the various listed businesses in the world, that will recover once they adjust to the new economic reality. Your financial adviser has also put you into a plan where you are able to leave your portfolio untouched during this period as your spending needs are taken care of, giving you the time to wait for the recovery. Remember, missing out on the best days of the market has a huge impact on your returns! (See Exhibit 1)

Bonds are a stabiliser. If your portfolio has bonds, then not all your invested capital is experiencing the market volatility. In fact, bonds have been going up in this period as their negative correlation to stocks usually means that in times of stock market stress bonds rally. From 17th Feb to 27th Feb, US 10 year treasury yields fell from 1.58% to 1.26%, a historical low (Bond prices rise when yields fall). This rally in bonds will reduce the impact of equity volatility on your overall portfolio.

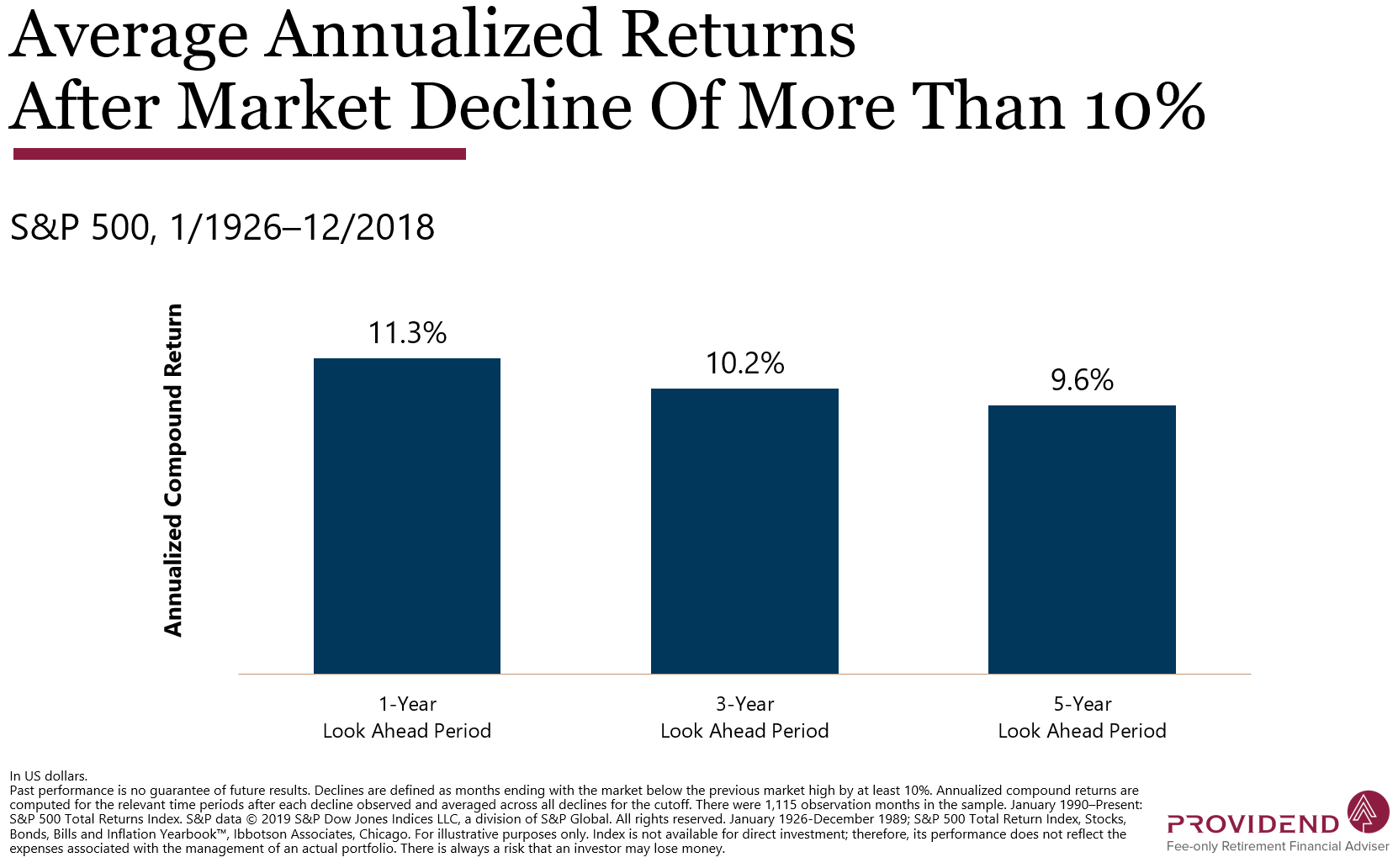

Focus on your financial plan. Instead of worrying about the markets, take the chance to assess your financial situation and goals with your adviser instead. Does the economic impact of the COVID-19 situation affect your financial situation in any way? Or is there an opportunity here to take advantage of lower prices in the stock market to improve the expected return of your investment portfolio? (Stocks usually do well after a correction. See Exhibit 2) It is a good time to have a discussion with your adviser on next steps should you want to adjust your plan, invest more money or even just for more information on how your portfolio is doing in the current situation.

Exhibit 2

While we brace for some challenging times ahead both in the markets and also at home in Singapore, we at Providend have been preparing some time for an event like this in the markets, to ensure that we have a plan to keep clients investment portfolios and financial plans on track. Recently, we have also mentioned to clients that it is good to look at any market corrections with the mindset that it is an opportunity to invest some spare cash, to take advantage of lower prices and higher expected returns.

Our advisers are always available to discuss your situation with you and to listen to your concerns. Do give them a call! As always, while it seems like a bad situation now, history has shown that life eventually must go on. Humanity has come through various epidemics like the Spanish flu, Ebola and of course SARS, so eventually, we will also figure out a way to overcome COVID-19. Let’s keep our eyes on the future and make sure our financial plans and investment portfolios emerge from this situation in good shape.

Thank you for your continued trust and support and do stay positive in these uncertain times.

Warmest Regards,

Solutions & Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.