We ended January with a note to clients on the impact that the Coronavirus is likely to have on our portfolios and discussed various ways our portfolios manage risk to reduce the downside impact (Please contact your Client Adviser if you want a copy of the note we sent out on 28th Jan). It appears that the market’s pessimism at the end of January was somewhat misplaced. In just 4 days, we are back to talking about new all-time high records for the S&P 500 and NASDAQ indices and recovery in other global equity and even emerging market indices.

While we cannot predict the future impact to companies’ profits from the Coronavirus outbreak, strong US economic data such as 291,000 jobs created in Jan and a faster pace of growth for US services (as measured by the ISM survey) have given US stocks a reason to rally higher. This means that the S&P 500 is at a new record of 3,334.69 as of closing on 5th Feb 2020. The Stoxx 600 Index which tracks European stocks hit a record high at the open on 6th Feb 2020.

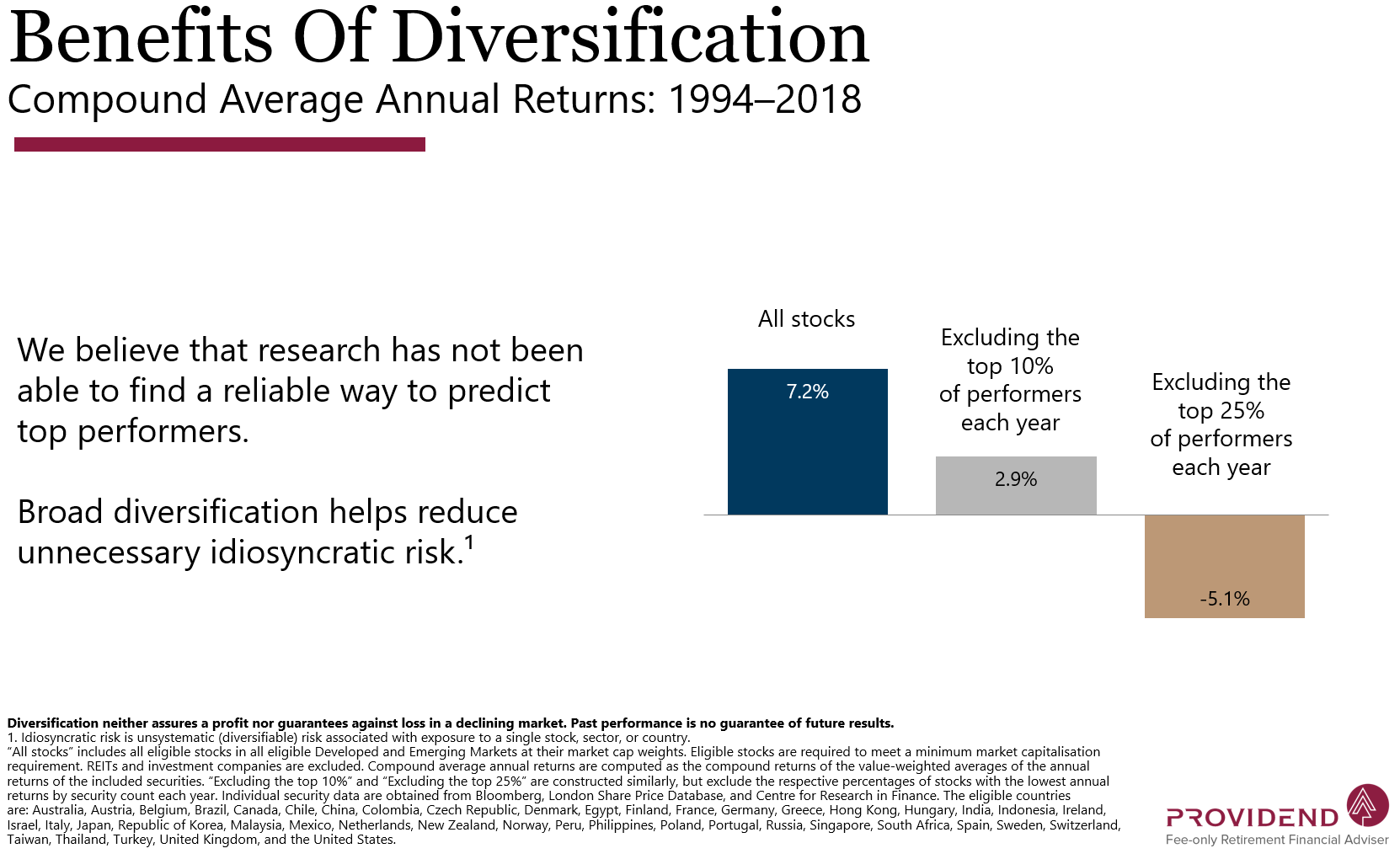

While the indexes are up at new highs, it does not mean that every stock is back at a new high. Airline and energy stocks remain battered as their industries are facing a sharp drop in demand from China. The good news is that because you are invested in a globally diversified portfolio, your portfolio has a very high chance of owning the stocks that are doing well in any particular period, improving your returns. (See Exhibit 1)

Exhibit 1

In this case, your portfolios will have bounced back quickly from the rather dismal end to January, as we encouraged you to stay invested and focus on your long-term goals, not letting a short-term event colour your decision making.

We hope that this brings some cheer to our clients during these trying times as Singapore deals with the Coronavirus outbreak. Do focus on keeping yourself healthy and keep in touch with your Client Adviser as they continue to keep your finances healthy!

Warmest Regards,

Solutions & Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.