The start of August marks an important milestone for Providend, as it has been three years since we started incorporating Evidence-Based funds from Dimensional, and Index funds from Vanguard into our portfolios.

It was the last step of a year-long shift that began with us creating portfolios from index-tracking exchange-traded funds, as we sought to align our investment portfolios with our investment philosophy of trusting in market prices (i.e. not market timing), staying invested for the long term and focusing on financial goals, not on investment returns.

Instead of spending our energy adjusting our portfolios’ asset allocation, or constantly selecting new fund managers to add to the portfolio, we focused on keeping clients in their seats during the bumpy periods in the market. Instead of selling when the market fell, we encouraged clients to add to their investments when lower prices offered higher expected returns. It might seem like we have done nothing with our portfolios, but we have been focused on doing the right things for you.

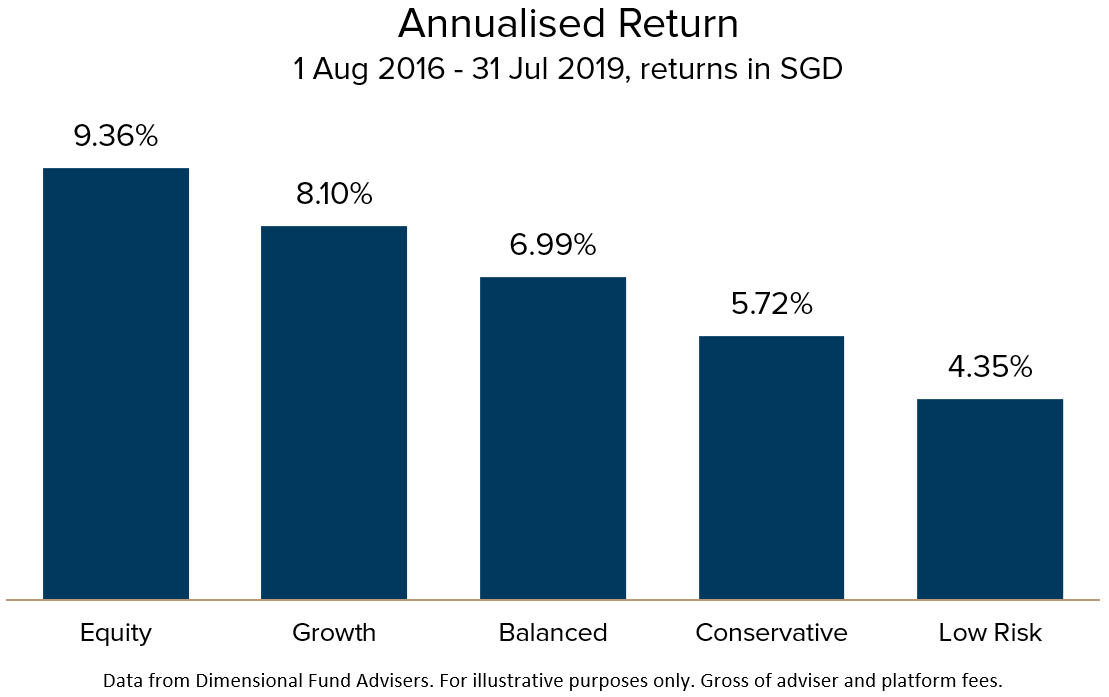

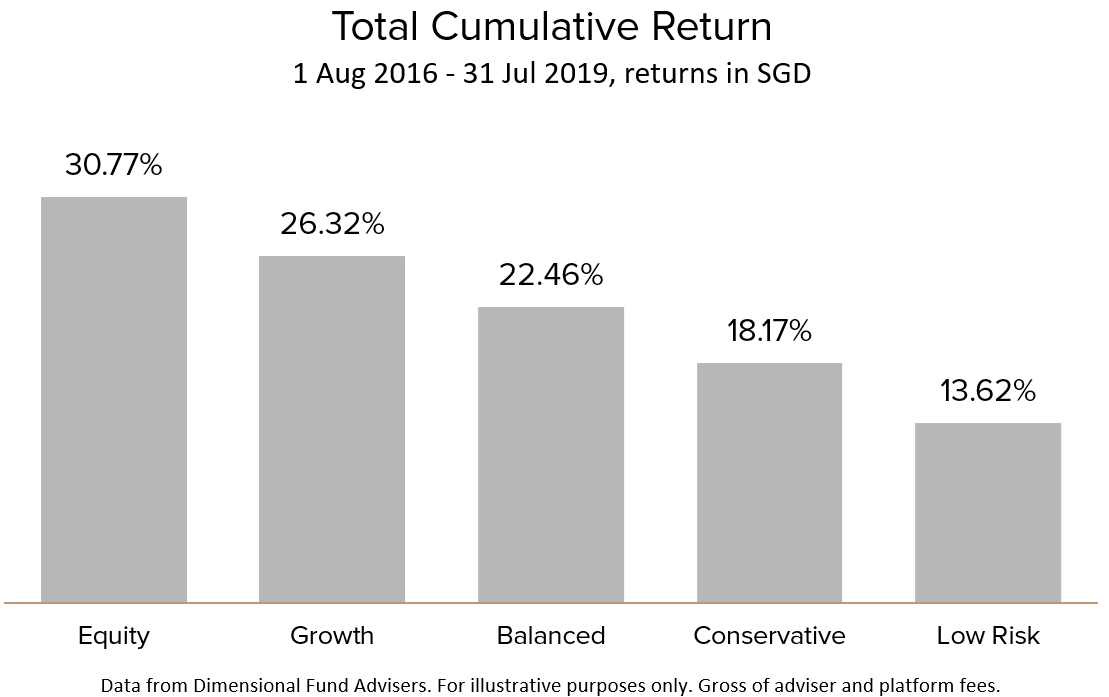

How have the portfolios done in these three years of “not trying to act busy”?

It has not been a smooth ride for the past three years. In fact, it is never really a smooth ride in the markets. We experienced an almost 20% drop in US equities in late 2018, emerging markets have had a challenging time ever since the trade war started, and in 2019 we have already had a -6% month for equities in May.

July was also a mixed month, with global equities giving up most of their gains in the last day of the month after the Fed signalled that more rate cuts were not on the way after delivering a 25bps cut. Emerging markets were down for the month, while fixed income remained the only bright spot. Yet in between, the S&P 500 managed to hit a new historical high of 3025.86 on 26th July this year.

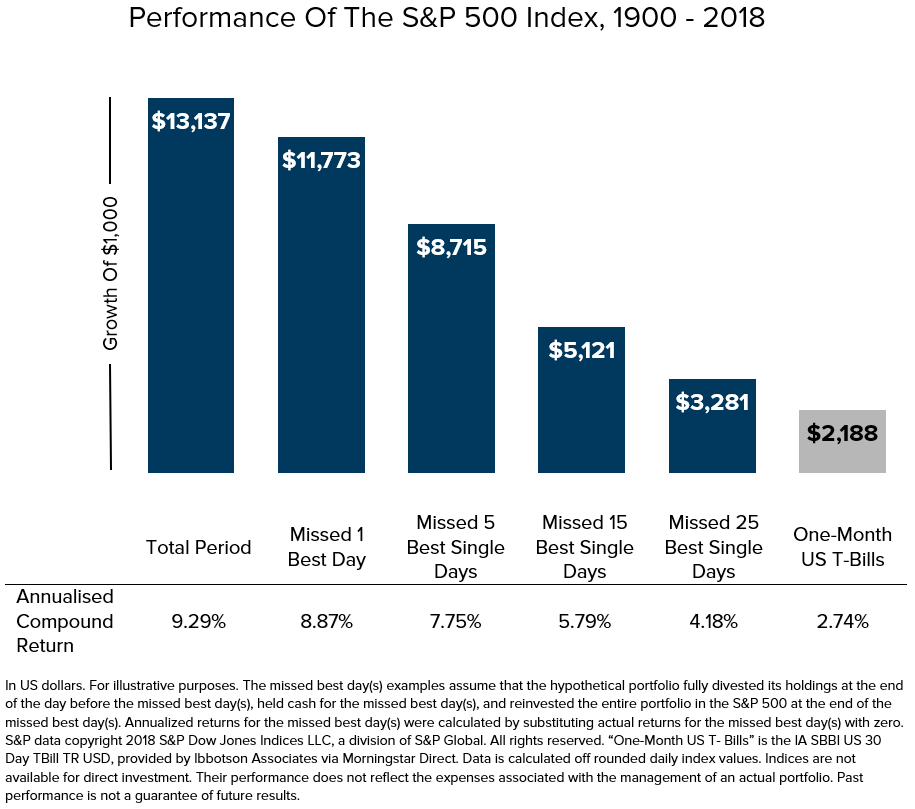

While it can be tempting to try to react to the market news, it is difficult to make the right calls consistently. Our portfolios delivered these returns because we did not focus on reacting to the market, but instead trusted in the long-term return premiums from investing in the asset classes. Research shows that missing out on just the 5 best performing days in the market can lead to a substantial difference in returns (see exhibit 2 below).

As always, we would like to continue to encourage clients to keep their financial goals in mind and focus on the long-term picture to get the best investment experience possible. Our advisers are always available should you have any concerns, and will do their best to keep you invested as they have done through the various rocky periods in the past three years so that we can help you get closer to achieving your financial goals.

Thank you for your continued trust and support, and all of us at Providend would like to wish our clients a very Happy National Day!

Warmest Regards,

Solutions & Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.