What do stocks do after one of the worst Decembers on record (in terms of market performance)? Start 2019 with one of the best first quarters in history! (For global equities. STI is another story).

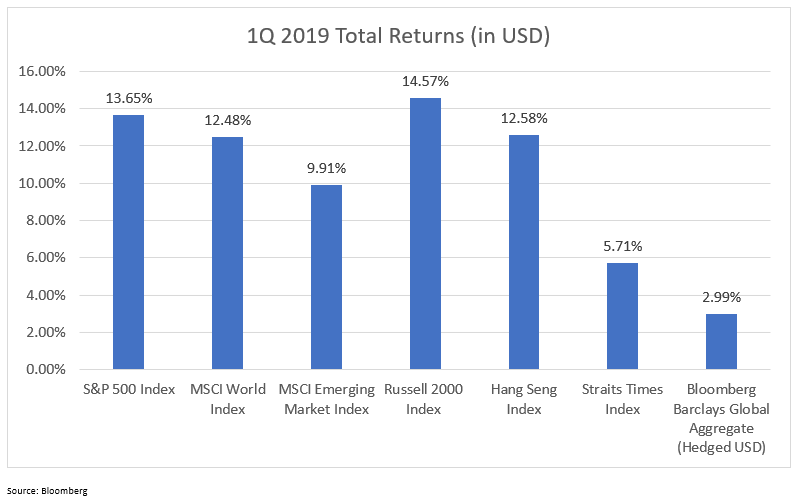

Large-cap stocks did well for the quarter with the S&P 500 up 13,65%, lifting the global MSCI World index to a 12.48% return for the quarter. Small caps did even better with the Russell 2000 Index up 14.57% for the quarter. Emerging markets did their part with a 9.91% return in the quarter, as the Hang Seng Index posted a strong 12.58% return for the first three months of 2019. In fact, the Hong Kong market is almost starting a new bull market, up 20% from its October 2018 low.

Bonds had a fantastic start to 2019 with the Bloomberg Barclays Global Aggregate Index up 3% in the quarter as a pause in the rate hike cycle by the Fed, and an earlier than expected end to the balance sheet runoff has boosted the demand for long term bonds. The 10-year treasury yield is now 2.416% as compared to 2.684% at the end of 2018 and was as high as 3.23% in Nov 2018 before the talk of a ‘pause’ in rate rises started.

The equity rally has come on the back of a period of scepticism as EPFR Global data recorded outflows from US stock funds for almost every week (bar two) this quarter. Aside from $9.I billion the week of Feb 27 and $25,45 billion the week of Mar 13, every other week in 2019 so far has seen negative flows from US stock funds. So, even though investors have been pulling out of US equities, the markets have risen, and should the data turn more favourable or some geopolitical overhangs (such as the US-China trade war) resolve themselves, they might find further support as investors switch back in.

Thankfully, while we monitor the markets closely, we don’t let market events guide our investment decisions. In keeping our clients invested, our portfolios have benefitted fully from the strong rally in IQ 2019 and have mostly recovered from the fall experienced in late 2018.

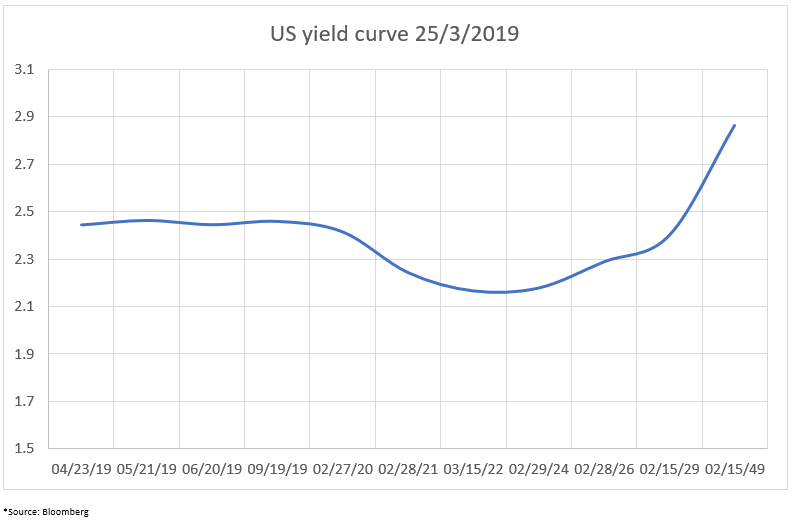

March has also been all about the inverted yield curve after the 3-month Treasury bill yield rose above the 10-year Treasury note yield. This happened after the Federal Open Market Committee (FOMC) meeting in March that was more dovish than expected, stoking concerns that US economic growth might fall in the coming months.

The above chart shows what the inverted yield curve looks like, with the shorter maturity bonds yielding more than the longer maturity bonds (the dates on the x-axis represent on the curve Treasury maturities). This is usually newsworthy because it is one of the possible indicators of a US recession, as the past seven recessions have been foreshadowed by an inversion of the yield curve. (According to the Federal Reserve Bank of Cleveland data).

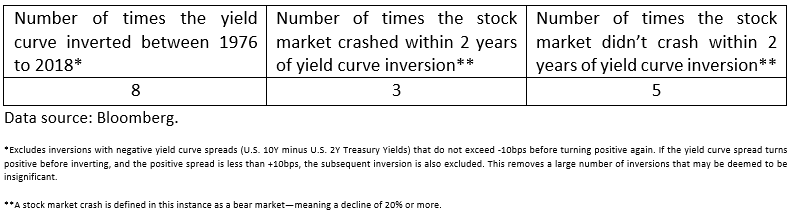

While it is a potential indicator of recession, it is not necessarily an indicator of how the stock market would perform. We have looked at how reliable yield curve inversions are at predicting a stock market crash and tabled the data below.

From the table, we see that it has less than so% chance of predicting a stock market crash, so it is also difficult to use this data to make an investment decision.

The good news is that at the end of March, the 3-month yield has moved below the 10-year yield, bringing some normality back to the yield curve and reducing the fears of an impending recession.

We cannot predict the future, but we can take stock of our present situation and adjust our plans. If you have any questions about your financial plan or your current position, you can contact us for a non-obligatory discussion or a review today.

Warmest Regards,

Solutions & Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.