Without a doubt, this has been one of the worst quarters in financial markets in a long time, and the worst since 2008. The COVID-19 pandemic has caused an unprecedented pause in economic activity across the world, triggering one of the fastest falls in US stocks with the S&P 500 index taking only 16 days to fall into a bear market (defined as a 20% fall from a peak). Alongside the equity market fall, we have an oil shock as the pandemic has reduced demand for oil dramatically, at the same time there is a large supply as the US has become a net exporter of oil in recent years due to the shale oil boom. This has resulted in oil prices at their lowest level in 18 years, and the world fast running out of places to store its surplus oil. All this triggered a freeze in the fixed income markets as investors rushed into cash (specifically the USD, driving it up to more than 10 year highs) and made even US treasuries, the largest fixed income market at US$14 trillion, difficult to trade.

The response from central banks and governments has been very determined, with central banks using all their monetary tools to support the financial system and keep it from collapsing. The Federal Reserve has led the way, reviving its 2008 crisis tools and even adding to them to help keep the financial system working. The Fed has pledged to buy unlimited amounts of US Treasuries and Mortgage-backed securities and deployed $300 billion into buying investment-grade corporate debt (including ETFs), to alleviate the liquidity crunch in the credit markets. It has also reopened USD swap lines to major central banks like the ECB, the BoJ and even to Singapore via MAS and major emerging economies in Asia and Latam. In addition, it has also increased the maturity of the swaps to 3 months from 7 days previously as well as implemented a new tool, a repo facility for foreign central banks to swap their holdings of US treasuries for USD. (A repo is when a financial institution pledges collateral, in this case, US treasuries in return for a short-term loan of USD).

The ECB has committed to buying EUR 750bn of government bonds without issuer limits that it imposed during its previous Quantitative Easing (QE) program while allowing itself to buy bonds with a maturity more than 70 days (from 1 to 30 years previously), giving it more scope to support both short and long term borrowing in the Eurozone. The BoJ has doubled its limit for buying ETFs and REITs and will purchase 1 trillion Yen more of corporate bonds and commercial paper while starting a lending program for commercial banks worth 8 trillion Yen.

These steps by central banks support the financial system, allowing businesses and banks access to cash and credit to continue making and receiving payments for goods and services. The financial system supports the real economy, and that has also received support from fiscal spending by governments. In Singapore, the government announced a supplementary budget called the Resilience budget, committing to spend an additional SGD 48bn to help industries impacted by the economic shutdown due to the pandemic. Elsewhere, the US has committed USD 2 trillion in support for its economy, while Germany has increased its borrowings by EUR 150bn to pass a supplementary budget of EUR 156bn to support its economy. These are just examples as every government in the world is implementing plans to support their economies through a period of reduced economic activity as they work to contain the spread of the virus.

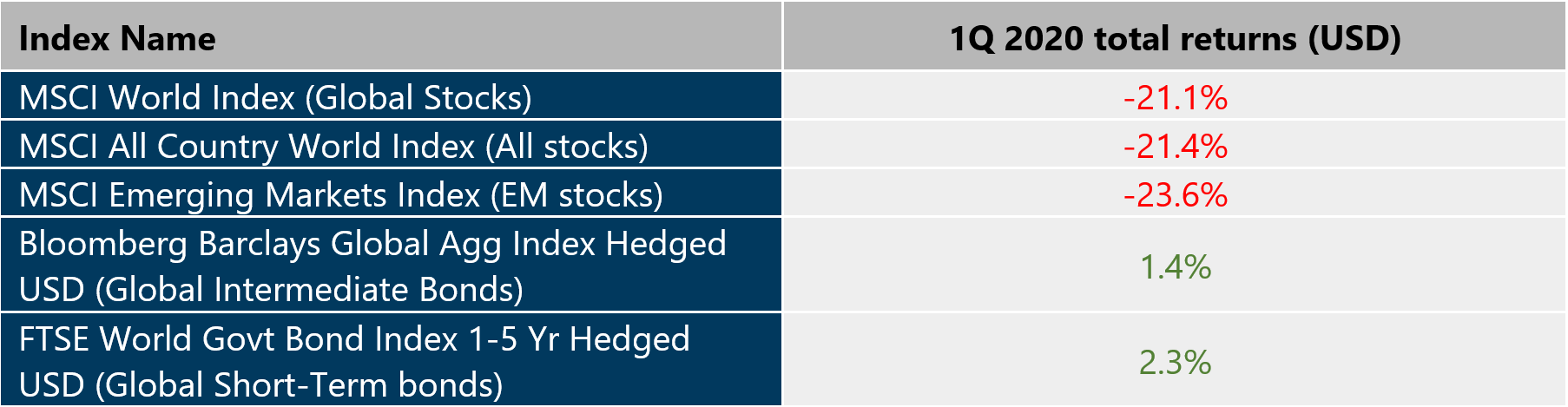

The table below shows the impact that the pandemic has had on the markets in 1Q 2020.

As seen from the table, the actions by the central banks have kept fixed income markets functioning, allowing it to act as a stabiliser for the portfolios that have fixed income allocation to preserve client capital.

Will things get better in the markets?

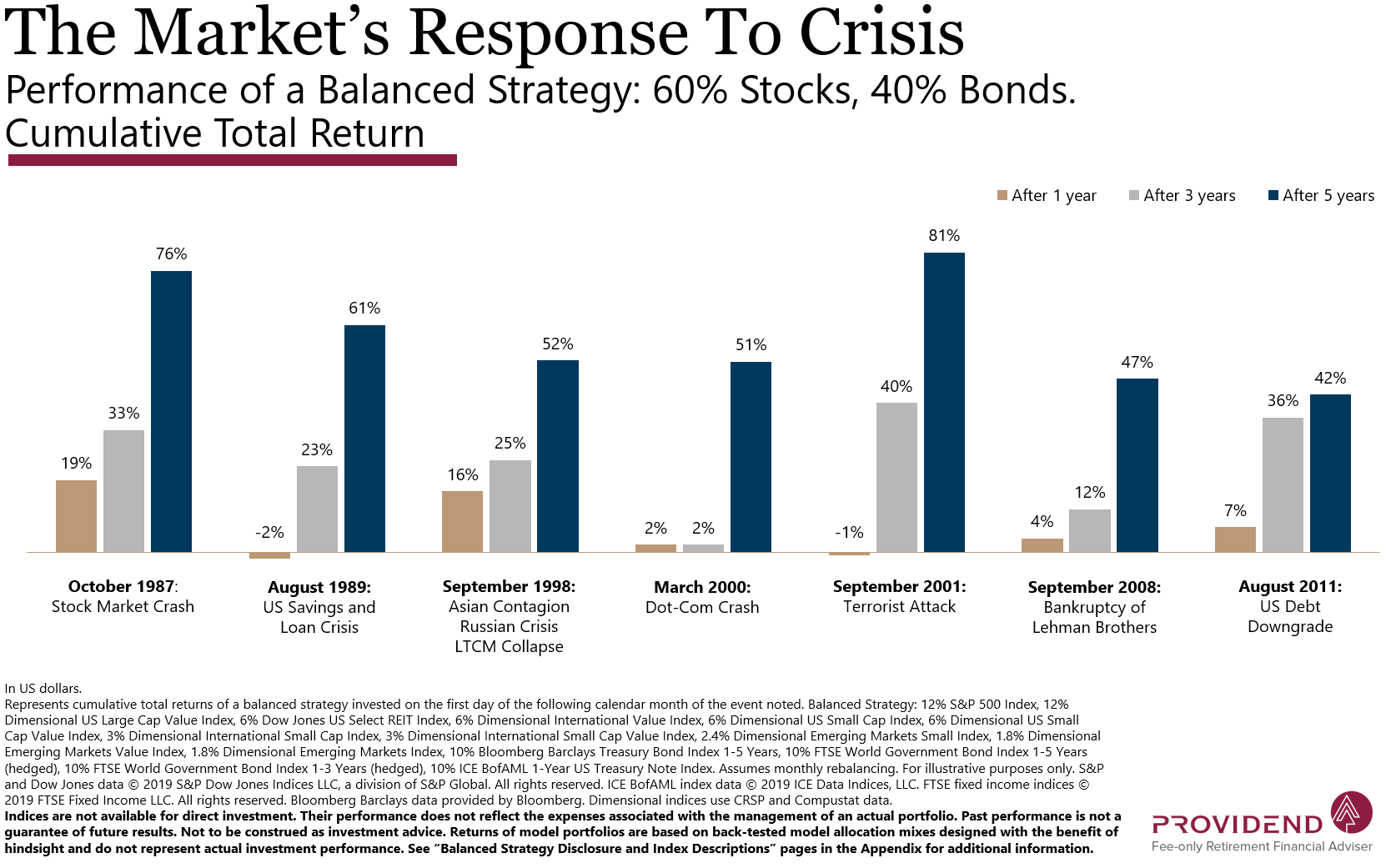

Financial markets are always forward-looking. The world is working to overcome the virus in various ways. Vaccines are being tested, companies are moving manufacturing lines to produce masks and ventilators instead of cars and electronic products. Distilleries are using alcohol to produce hand sanitiser instead of spirits. Right now, the markets are pricing in low revenues/cashflow, dividend cuts, and higher debt levels, and as we have explained before, markets are efficient and are reacting to the bad news by lowering the prices of securities. At some point, we don’t know when, economic activity will pick up, and markets will start to price in better times and asset prices will recover.

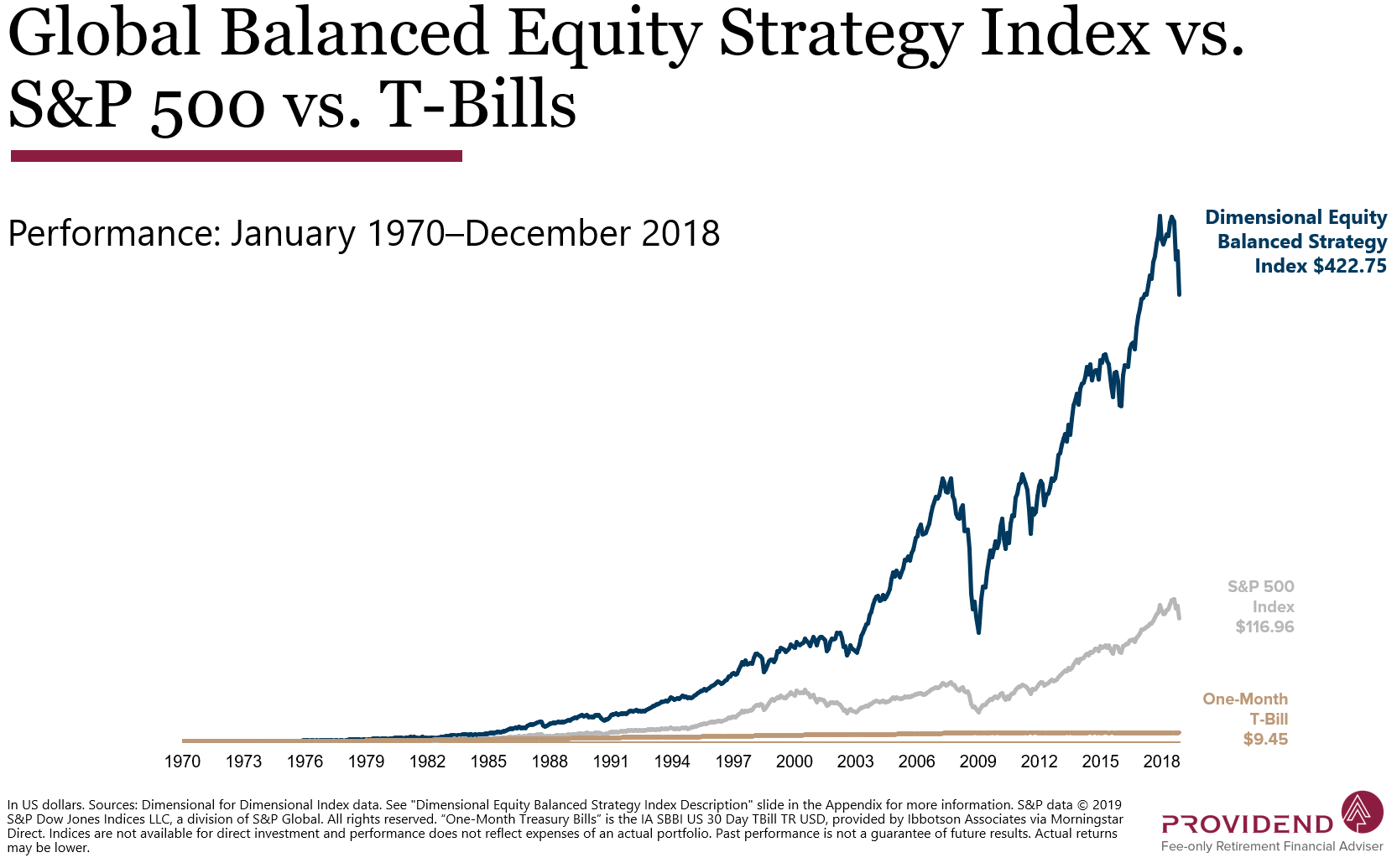

Exhibit 1: Since 1970 markets have gone up despite all the challenges the world has faced. A balanced and diversified strategy is even more consistent

How do we ensure that our portfolios will recover?

One way to ensure that portfolios will be a part of the recovery is to remain invested. We cannot predict when the market will turn, but we know that when the recovery happens the markets quickly start to price in better times (think back to April 2009). The only way to be a part of that is to stay invested, and the penalty for missing out can be quite material.

Exhibit 2: Markets recover after a crisis, but you have to be invested to get that return

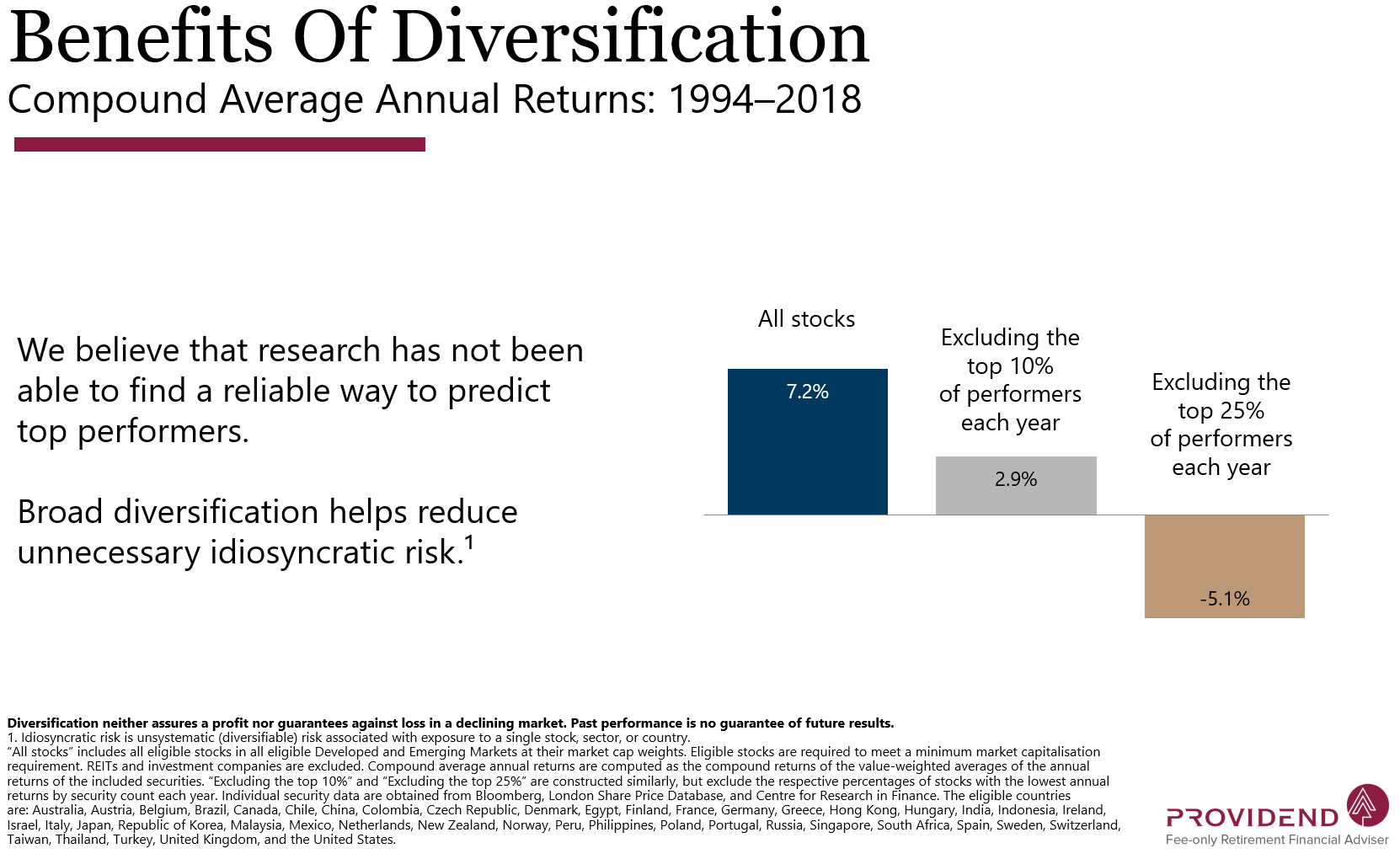

The other way to ensure that portfolios recover is to be diversified. This is a public health crisis that has precipitated an economic crisis. Various industries are facing difficulties operating business as usual, and we cannot be sure which companies will make it through this challenging period. By making our portfolios very diversified, we can be confident that we will be owning the companies that make it through this crisis and will participate in the recovery. The Dimensional Global Core Equity fund which is in many of our portfolios has over 8,000 stocks. The World Equity Fund in some of our portfolios has over 10,000 stocks. That is a lot of diversification!

Exhibit 3: If you are diversified you will be able to own the top performers of each time period

As we look ahead into 2Q 2020, it doesn’t seem like things will get better soon, as lockdowns continue to get extended or intensify to deal with the continued spread of the virus. We will continue to monitor the investment portfolios closely and are in close communication with the fund managers and platform provider so our clients can rest easy knowing their investment portfolios are secure.

During these uncertain times, do take care of your physical health and well-being. We at Providend are joining in the effort by making the entire office participate in telecommuting to improve our social distancing measures and reduce the burden on Singapore’s frontline healthcare workers. Your advisers are still available to chat via video calls and can still meet up with you if that is your preference. Do get in touch with them if you have any questions or concerns.

Thank you for your continued trust and support.

Warmest Regards,

Solutions & Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.