The rumours of the demise of the value premium have been greatly exaggerated. We begin with a paraphrase of a quote from the famous author Mark Twain when asked about his health by a reporter. This is because there have been many questions asked in recent years about the health of the value premium. Low-interest rates, coupled with low growth in the past 10 years have seemingly thrown a hundred years of evidence out of the window, as a sustained period of underperformance has led to many questioning the validity of the value premium.

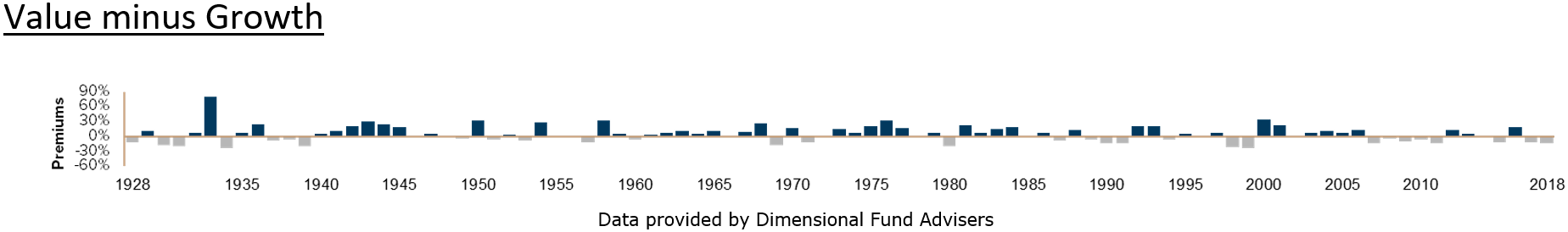

The graph above shows the relative outperformance of value vs growth for the past 90 years, with the value premium being an annualised 3.13% on average. The past 10 years have been dire for value though, as the premium has only surfaced in 3 of the 10 years. This along with the strong outperformance of growth stocks led by the resurgent tech sector has made it a challenging period for investors that have followed the evidence.

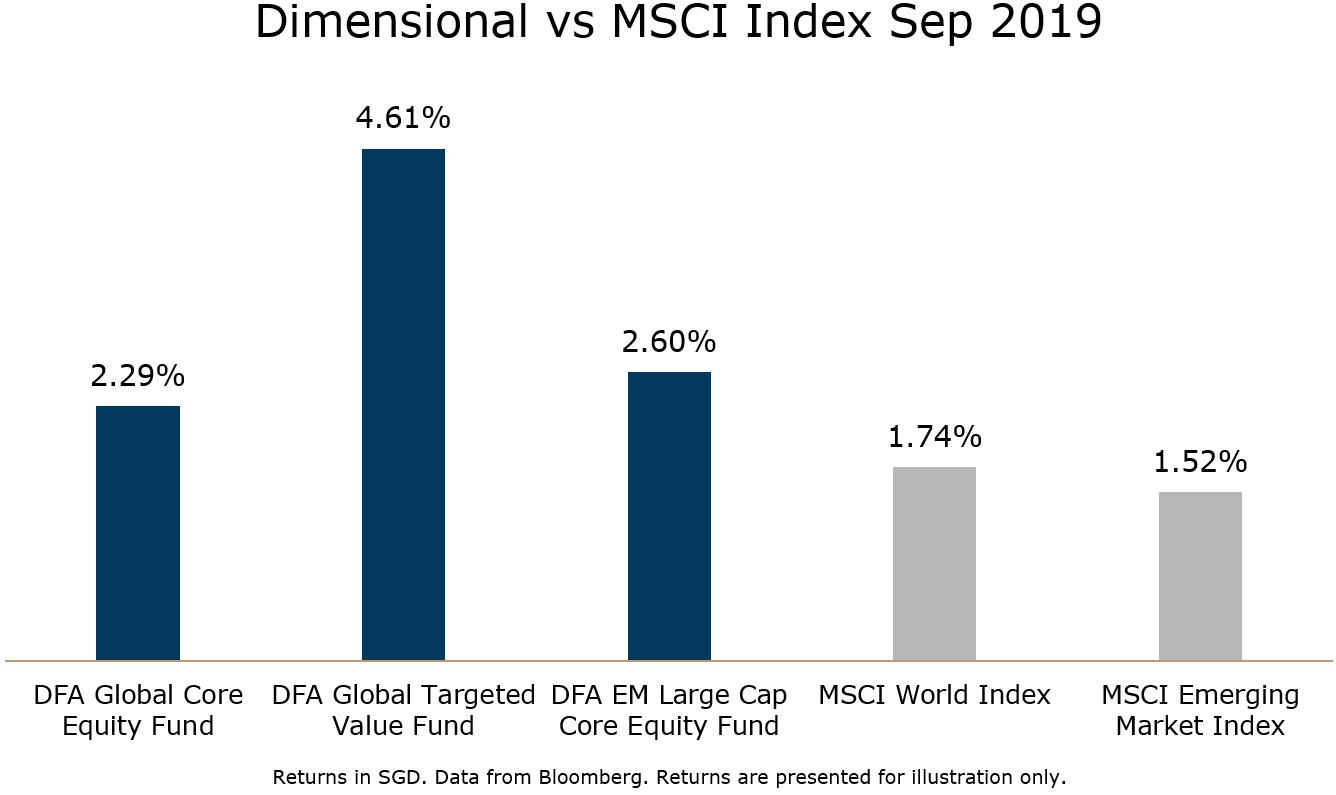

At Providend, we follow the data, and very thorough academic analysis has shown that the value premium does exist and is sensible, persistent, pervasive, robust and cost-effective (in implementation). That is why our portfolios look to deliver market returns (because it is very difficult to consistently beat the market) with a value tilt to take advantage of the higher expected returns that the premium offers. The Dimensional funds provide a cost-effective implementation that allows our portfolios to capture these premiums when they show up, and we are excited to share that value has come back in a big way in September.

All the Dimensional equity funds outperformed the market indices in September as a rotation back into value stocks helped value outperform this month. More importantly, our investment implementation has stayed consistent, with the funds outperforming when the value premium resurfaced, so you can expect your portfolios to benefit should the premium continue to be present.

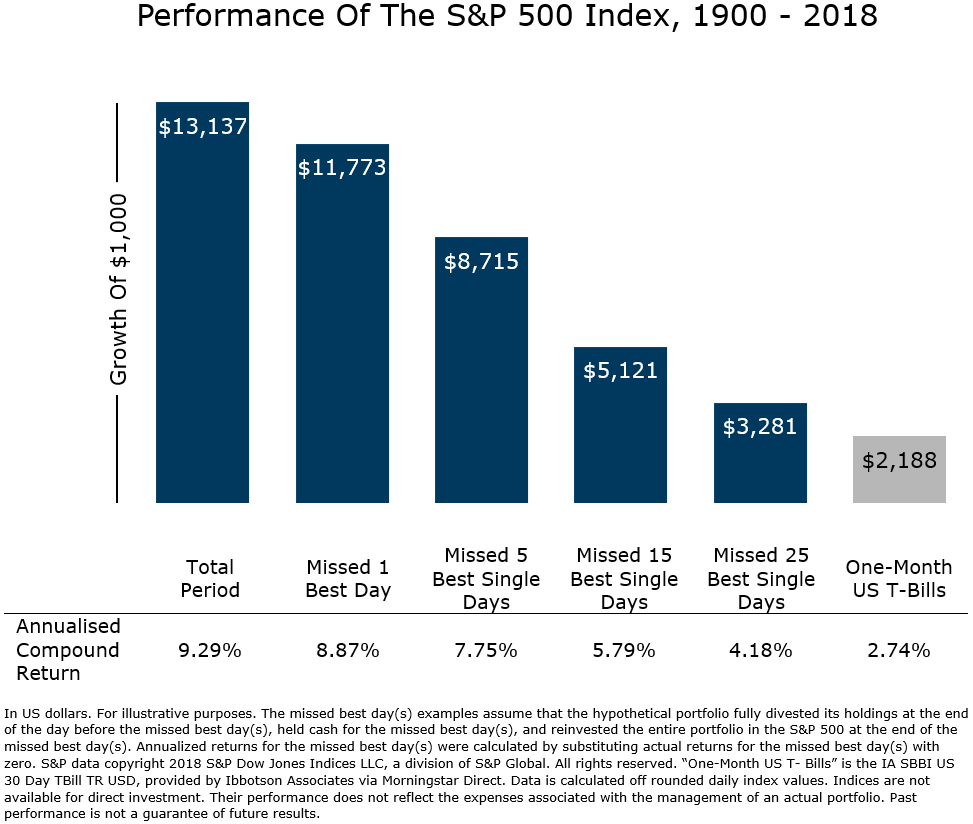

It is also important to note that our encouragement to clients to remain invested has paid off. August was a difficult month for equities, as the escalation of the trade war led to equities falling as global economic growth concerns resurfaced. While economic growth concerns remain, September was a much better month for equities as the US and China have agreed to restart trade negotiations, and investors started to adjust portfolios to account for slower growth (by rotating into value stocks). Overall, the S&P 500 gained 1.2% for the quarter, and the MSCI World gained a modest 0.53%. For the year, the S&P 500 is up 19% and the MSCI World is up 17.61%. Staying invested has allowed our portfolios to capture these returns, and helped clients avoid being out of the market during the best days, which can impact returns significantly.

As we head in the last quarter of 2019, we would like to encourage all clients to take the time to assess the past year and consider any changes to your financial situation. Should you feel like you need a review of your plan, please do not hesitate to give your Client Adviser a call to arrange a meeting. Thank you.

Warmest Regards,

Solutions & Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.