The mechanisms we discussed in the previous chapter are especially important because one of the key success factors to reach the financial aspects of our retirement goals is the ability to mitigate against investment risks. Often, this is taken to be volatility risk as well as the risk of losing your capital or not getting required returns when you need them. We will talk more about those investment risks later. But for now, here is an interesting story that demonstrates the possible effects of a less thought-about part of investing risk, particularly in retirement—sequence of returns risk.

Sequence of returns risk is the risk of receiving higher or positive returns during early years of accumulation and getting lower or negative returns in the later accumulation years. It is also the risk of lower or negative returns early in the period when withdrawals are made. To best illustrate this risk, let us look at Table 2-4 that show the tale of two retirees.

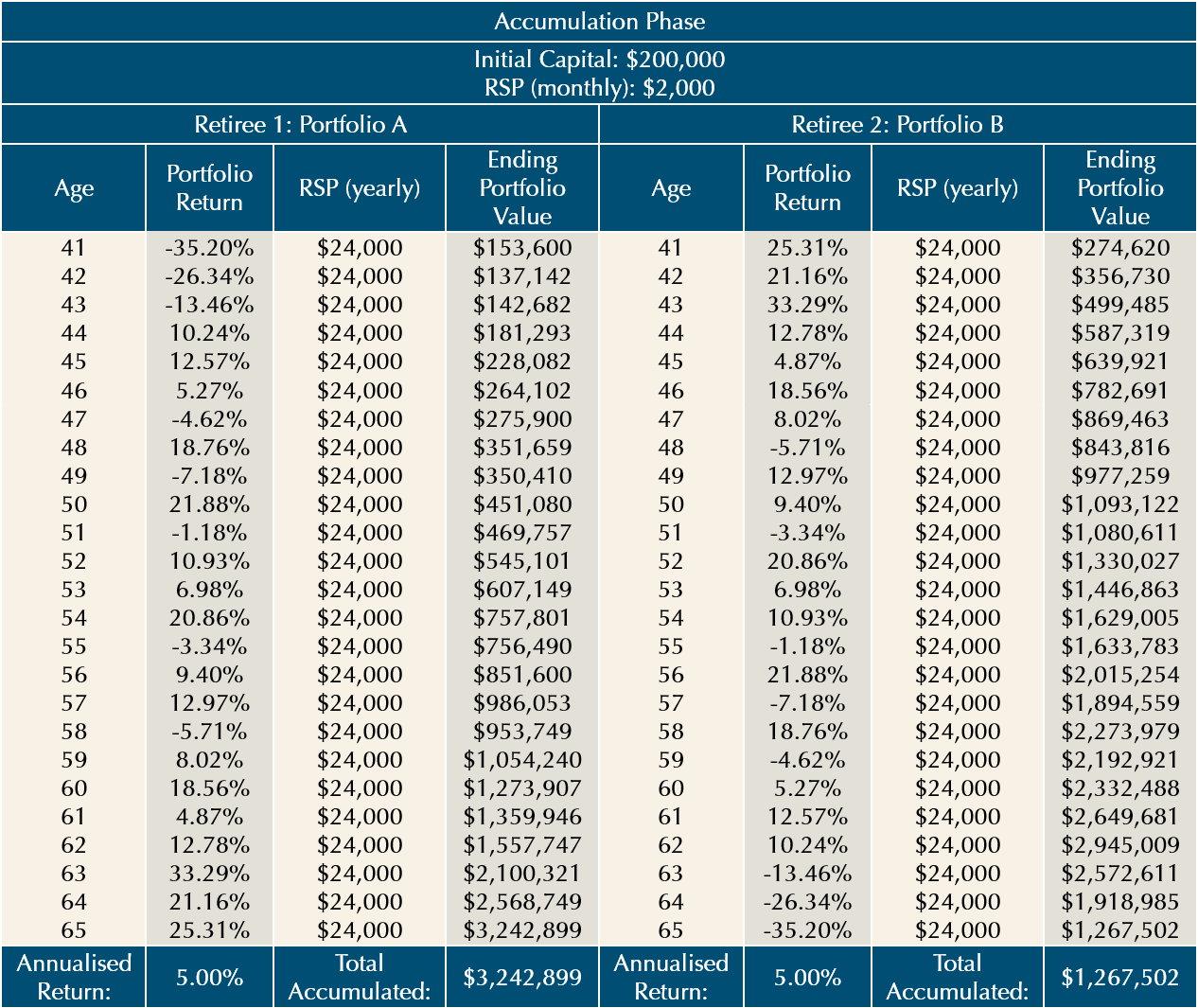

Table 2: Retiree 1 and Retiree 2’s portfolios with different sequences of returns during accumulation phase | Data source: Providend

Table 2: Retiree 1 and Retiree 2’s portfolios with different sequences of returns during accumulation phase | Data source: Providend

Table 2 shows Retiree 1 and Retiree 2 investing towards their retirement. Both started with a lump sum of $200,000 and faithfully saved $2,000 per month, but into different portfolios. Although the average annualised returns of these portfolios are the same over the 25-year period, the sequence of returns are different. Retiree 1 received lower or negative returns during the early years and higher or positive returns in the later years. Retiree 2 on the other hand, received higher and positive returns during the early years and lower or negative returns in the later years. Unfortunately, despite Retiree 2 investing faithfully every month and staying invested through the 25 years, at retirement age 65, he accumulated significantly less than Retiree 1.

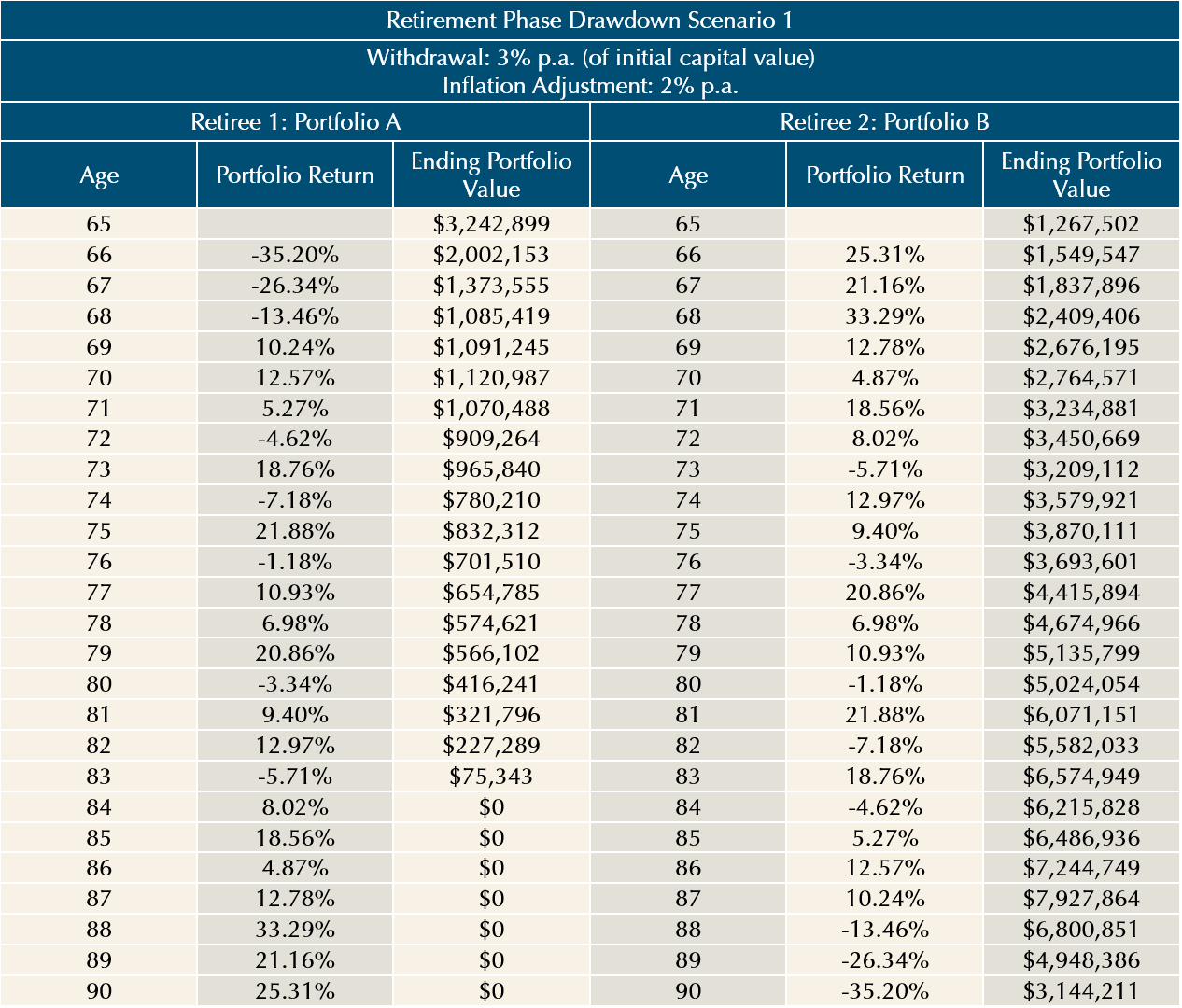

Table 3: Retirement phase 3% yearly drawdown with different sequences of returns | Data source: Providend

Table 3: Retirement phase 3% yearly drawdown with different sequences of returns | Data source: Providend

Table 3 shows the retirement years of the two retirees. An elated Retiree 1 withdrew $97,300 p.a. (3% of the initial $3.2 million) with a yearly adjustment for inflation. Although Retiree 2 very much wanted to have the same $97,300 to spend each year, he thought that since he accumulated much less, he would be more prudent and instead drew $38,000 p.a. (3% of $1.27 million) with a yearly adjustment for inflation. All the while, their monies were still invested in their same respective portfolios as during the accumulation phase. But then something happened. Retiree 1’s portfolio began to experience lower or negative returns in his early drawdown years while Retiree 2’s portfolio had higher or positive returns in his early drawdown years. In the end, despite the fact that Retiree 1 had accumulated more, he ran out of money by age 84. Retiree 2’s portfolio was still able to support him for a long time to come.

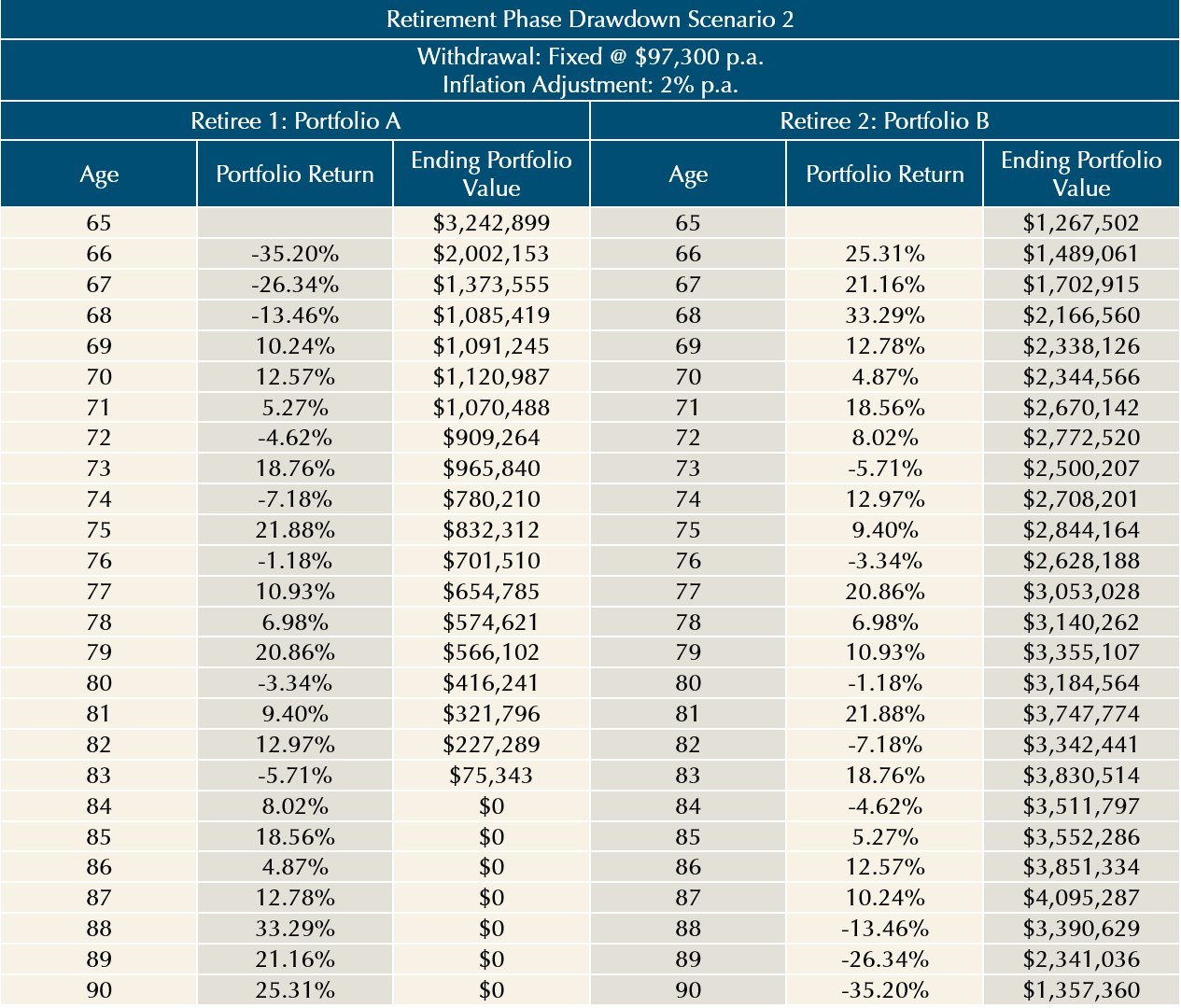

Table 4: Retirement phase drawdown at a fixed yearly amount of $97,300 adjusted for inflation with different sequences of return | Data source: Providend

Table 4: Retirement phase drawdown at a fixed yearly amount of $97,300 adjusted for inflation with different sequences of return | Data source: Providend

In fact, if Retiree 2 decided to be less prudent and follow Retiree 1’s footsteps by drawing down a yearly fixed amount of $97,300 (adjusted for inflation as per Table 4), Retiree 1 would still run out of money first even though he had originally accumulated more – all because of the different sequence of returns.

The story of Retiree 1 and Retiree 2, though hypothetical, shows the importance of the sequence of returns which, unfortunately, cannot be controlled. During his accumulation phase, Retiree 2 could only blame his poor fortune, but subsequently count his lucky stars in retirement. In contrast, Retiree 1 who boasted about his good fortune during accumulation phase, saw lady luck leaving him in his retirement years. Do we have to subject our retirement to such luck and good fortune? Thankfully, we do not.

Dealing With Sequence of Returns Risk

While we have no control over sequence of returns, when accumulating assets, it would be wise to keep extra cash ready so that you can buy into your portfolios when there are market shocks. This will help enhance your portfolio returns to mitigate against the sequence of returns risk. And if you plan to retire at age 65 like the gentlemen above, aim to reach your retirement goal a few years in advance and shift the accumulated amount into the RetireWell™ buckets before fully retiring. This will minimise the risks of having poor returns nearing or in the earlier years of your retirement.

When it comes to drawing down in retirement, using a planning methodology, such as RetireWell™, ensures that retirees always have their safe retirement income floor in place and a healthy cash level for spending. This means that the need for them to draw from their invested capital for immediate needs is reduced and they can thus avoid pulling money out of the market at unfavourable times.

RetireWell™’s patent-pending Reserve Bucket also has retirees set aside an additional amount to be invested conservatively to make up for possible returns shortfalls in some of the earlier buckets.

Additional ways in which you can further reduce some of this risk is to assume a lower rate of return when planning and thus save more towards your retirement goal. This will help mitigate the risk, just in case the sequence of returns works against you.

Relying solely on an assumed average rate of return when planning for retirement, is often an oversimplification. And to simply draw down in a fixed manner directly from your portfolio regardless of market conditions is likely to be, at best, an uncomfortable experience and, at worst, a significant impediment to a secure retirement. The devil is really in the details. Your wealth adviser must tackle this “devil” with you by using the right tools and planning frameworks, as well as continuously review your retirement plan. Please do not leave your retirement to luck. You may end up having your money run out before you do.

The writer, Christopher Tan, is Chief Executive Officer of Providend, Southeast Asia’s first fee-only wealth advisory firm and author of the book “Money Wisdom: Simple Truths for Financial Wellness“.

The edited version has been published in The Business Times on 26 August 2017.

Here are the links to the RetireWell™ eBook chapters:

- Part 1: Drawing Down Retirement Money

- Part 3: Ensuring a “Safe Retirement Income Floor”

- Part 4: Investment Philosophy for a Retiree Client

- Part 5: Stock Markets Always Rise Over the Long Term

- Part 6: Setting Aside Adequate Additional Buffers

- Part 7: Capturing Returns Effectively

- Epilogue 1: Purpose-Driven Retirement Planning

- Epilogue 2: Retirement – It’s About the Kind of Life You Want to Lead

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.