Now that we have secured a portion of the retirees’ desired income using the RetireWell™ Income Bucket, let us look at how we can invest the rest of their money in the other buckets to make up for the difference between the amount that Income Bucket provides and their total monthly desired retirement income, as well as ensure that this income is adjusted for inflation.

To recap, we used our proprietary tool, RetireWell™ to allocate Richard and Eva’s (age 60 and 58) investable resources in order to generate a reliable income stream throughout their retiring years. Their objectives were as follows:

- Spend $18,000 per month for first 5 years.

- Reduce to $15,000 per month for the next 15 years.

- And finally, to $12,000 per month until Richard is 98.

At the end of that period, they would like to leave $1.8 million behind for their loved ones or to use to continuing support themselves if they live longer.

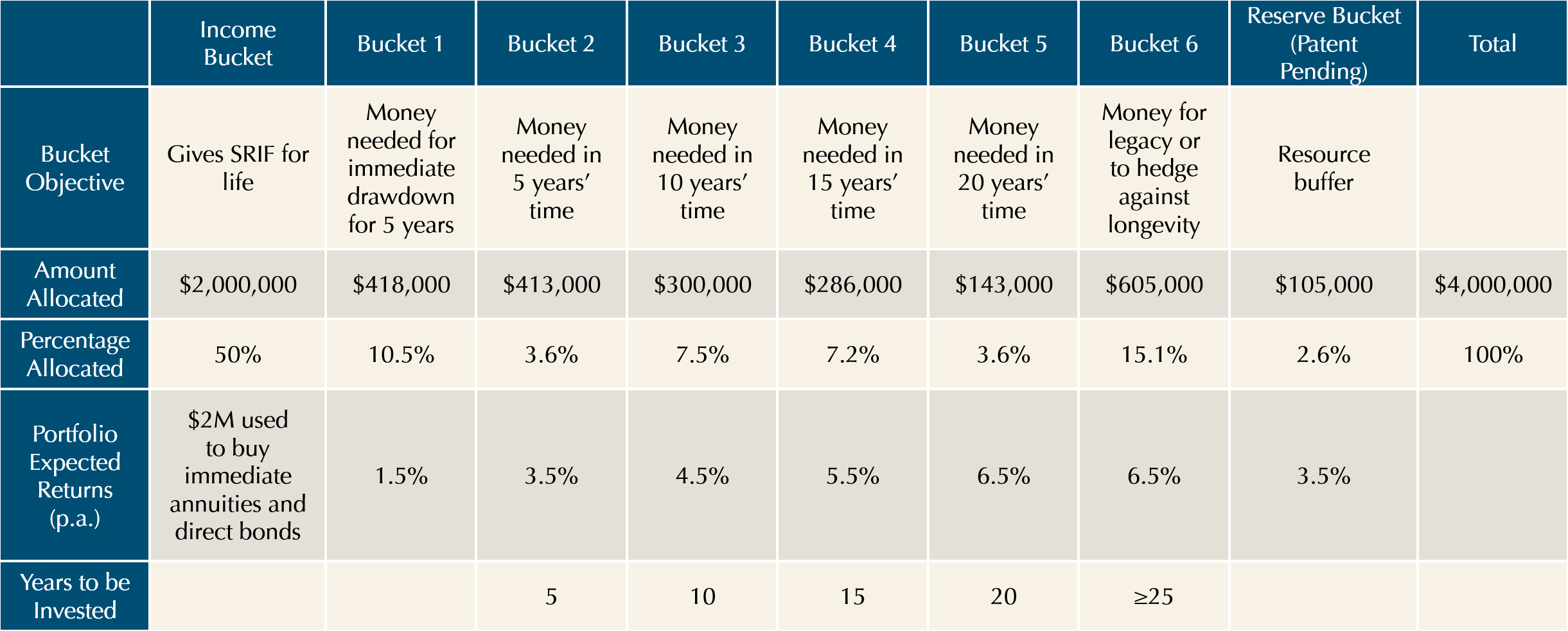

Based on what they want, we allocated $4 million of their money, together with their rental income and proceeds from their insurance policies into the various “buckets” shown in Table 1.

Table 1: How Retirewell™ Optimizer allocated Richard and Eva’s resources | Data Source: Providend

The money in the Income Bucket is used to buy annuities and direct bonds, while the amount in Bucket 1 is kept in cash or safe cash-like assets (e.g., money market funds etc.). The monies in the rest of the buckets are invested in portfolios as shown in Table 10.

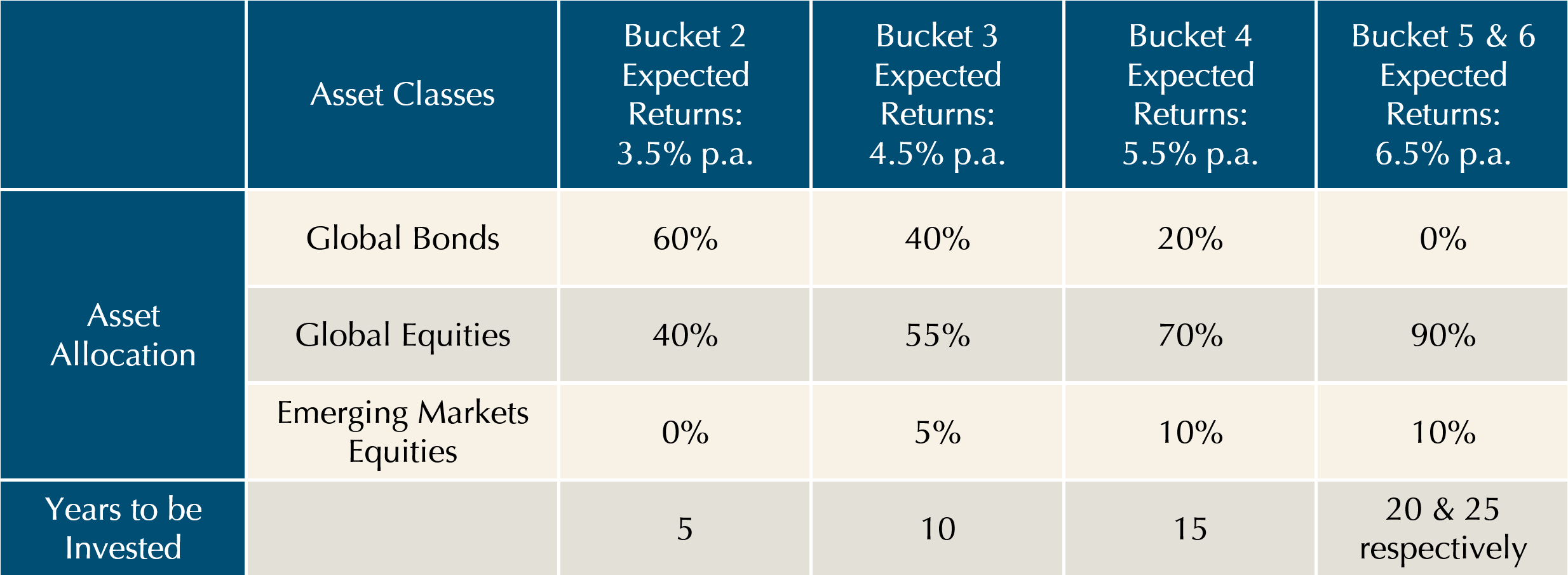

Table 10: How the various buckets can be invested | Data Source: Providend

The way the portfolios are invested is based on the principle that for portfolios with higher expected returns and risk, you need a longer time horizon. Our nearly 2 decades of investment experience also tells us that the best way to get these returns is to stay invested.

We execute the strategy and gain the appropriate portfolio exposures by using low-cost instruments such as ETFs, index funds from BlackRock iShares or evidence-based funds from Dimensional Fund Advisors. Importantly, once we have done so, we will not make predictions and changes to the asset allocation of the portfolios because of market news or historical trends—we will not time the markets.

These decisions have served our portfolios well.

How Has Our Investment Philosophy Fared for Our Clients?

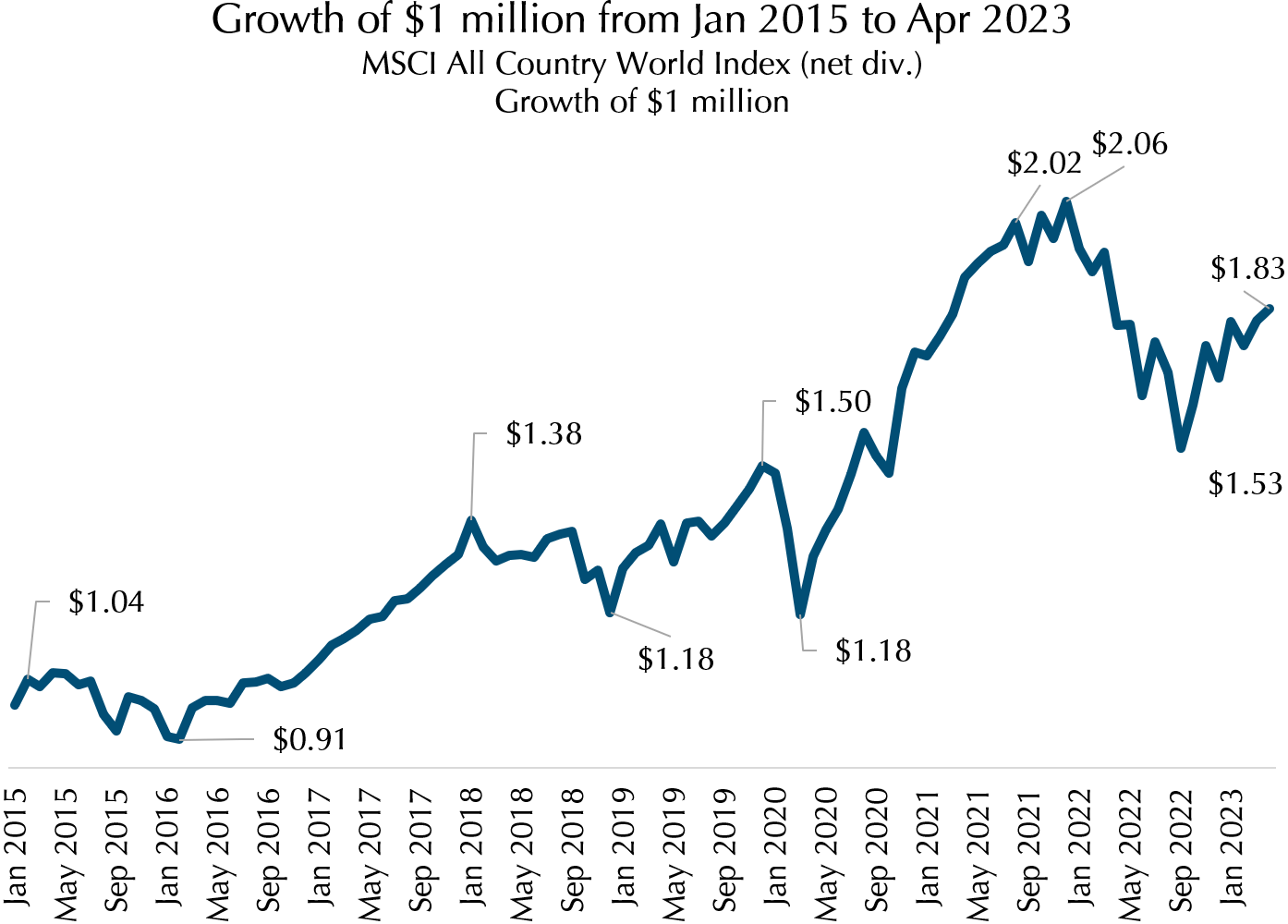

Chart 1: Growth of $1 million from Jan 2015 to Apr 2023 | MSCI All Country World Index (net div.) | Data source: Dimensional

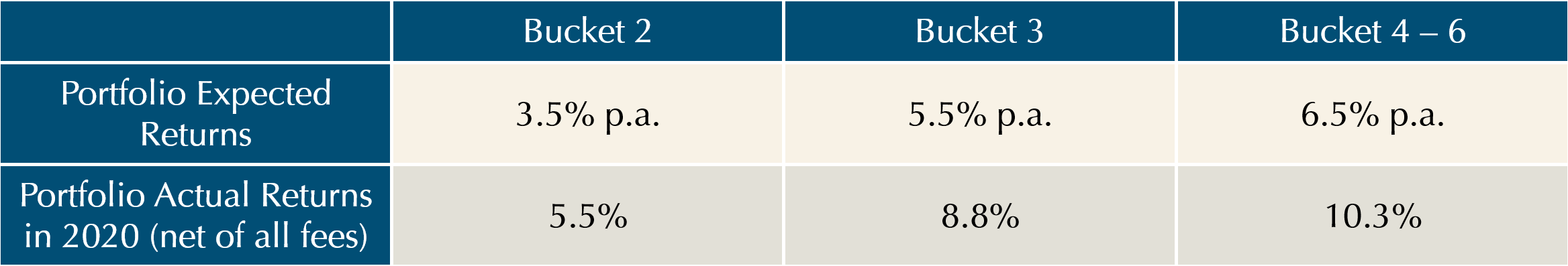

If you were investing in 2020, you would know that in the first quarter of the year, many analysts from various media channels made calls to move out of equities. They predicted that it would be a year when stock markets would crash. And of course, they had good reasons for it. 2020 began with the outbreak of the COVID-19 virus and it quickly turned into a full-blown pandemic. Country lockdowns, travel restrictions and containment measures disrupted global supply chains. But we stuck to our philosophy, and here were our results:

Table 11: Portfolio returns across buckets. Actual Returns factor in platform, advisory fees | Data source: Providend

We ignored calls to time the markets, stuck to using the right low–cost instruments, and simply rebalanced the portfolios when necessary. If you look at Chart 1, you will realize that if you heeded those market timing calls, you would have run the risk of exiting the market and missing the returns that came quickly with the subsequent recovery. While this way of investing calls for discipline and courage to ignore the noise, it allows our retiree clients to reap sufficient returns as well as avoid the stress of having to guess where the markets are going.

Most Active Managers Cannot Beat the Market

Those are not the only reasons why we choose an approach that relies on capturing market returns efficiently at a low cost. The truth is that there is a lot of evidence that taking a more active approach in selecting securities and timing the markets does not work well. Even amongst the professional fund managers whom we pay to invest skilfully, the vast majority do not best the market benchmarks in any given year or period.

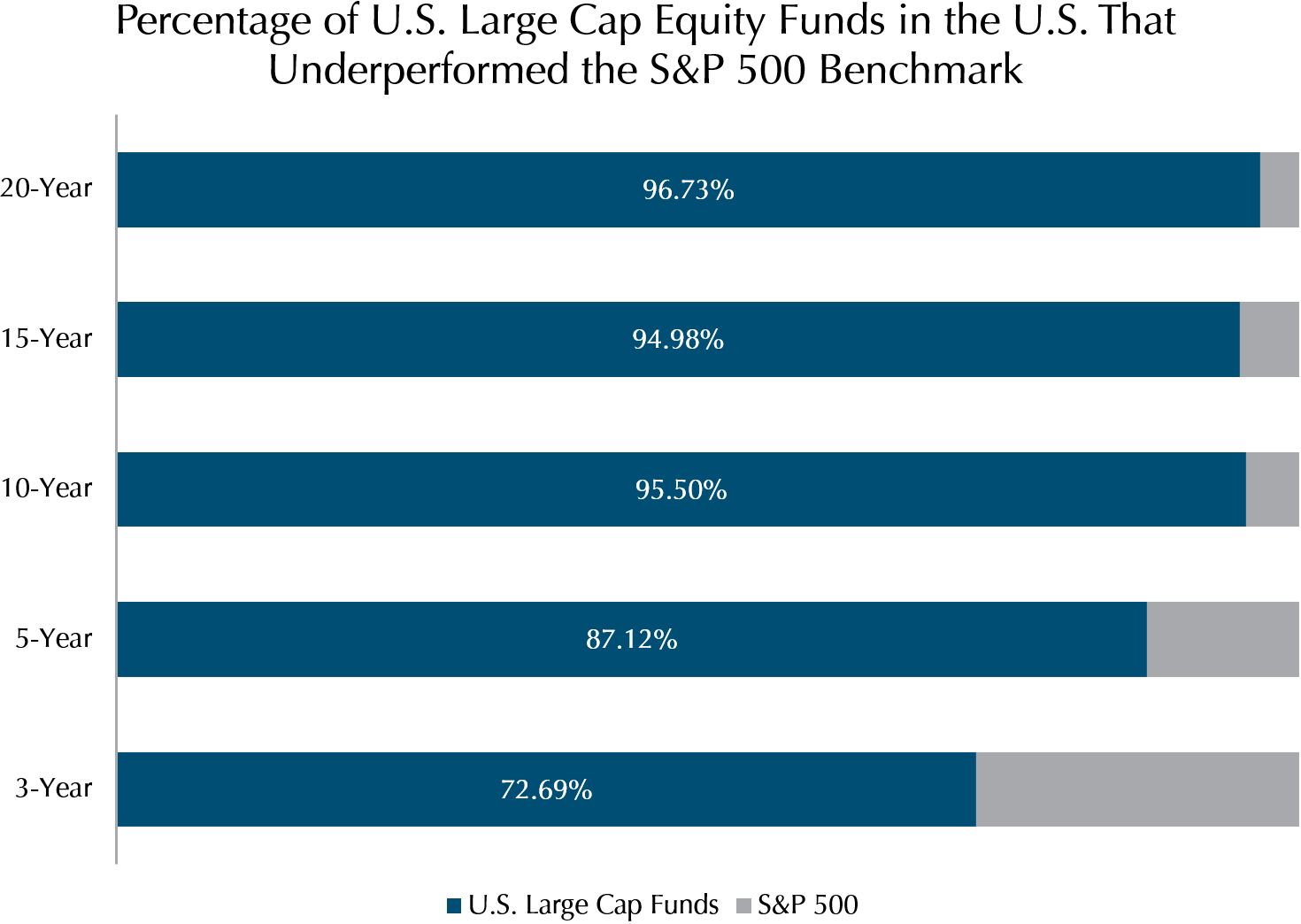

Chart 2: Percentage of U.S. Large Cap Equity Funds in the U.S. that underperformed the S&P 500 Benchmark. For illustration purposes only. Past performance is no guarantee of future results | Data source: S&P Dow Jones Indices LLC, CRSP. Data as of December 31, 2022

You might be thinking, “It makes sense that not all fund managers beat their benchmarks, but the data seems to show that there are indeed good ones that do. Why don’t I just pick those, then?”

And the answer is that, unfortunately, while some managers do manage to beat their benchmarks on occasion, they rarely do it consistently.

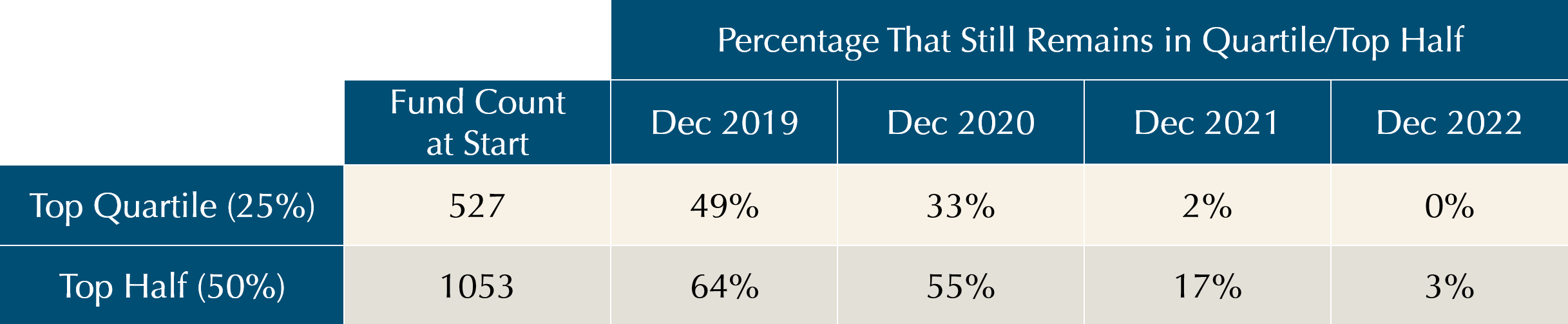

The latest data compiled by S&P Dow Jones Indices shows the persistence of U.S. equity fund performance over the past five years. The data and the conclusions we can draw from it could not be clearer: out of the top 25% of U.S. Equity Funds, which numbered 527, in December 2018, only 49% remained in the top 25% in the very next year. By Dec 2022, none of the initial 527 funds – remained in the top quartile. This shows the inconsistency of active fund managers, and how a strategy of simply looking for the best fund performers in any given year is likely to fail.

Table 12: Performance persistence of U.S. Domestic equity funds over five consecutive 12-month periods. For illustration purposes only. Past performance is no guarantee of future results | Data source: S&P Dow Jones Indices LLC. Data as of December 31, 2022

Why risk your retirement by trying to find the rare manager who can beat the market consistently? The odds of picking the right champion are absolutely terrible.

Remaining Invested Over the Long Haul

Instead, if retirees stick to investing in low-cost ETFs, index funds and evidence-based funds and keep invested over the long run without attempting to time the market, they are likely to get the returns that they need.

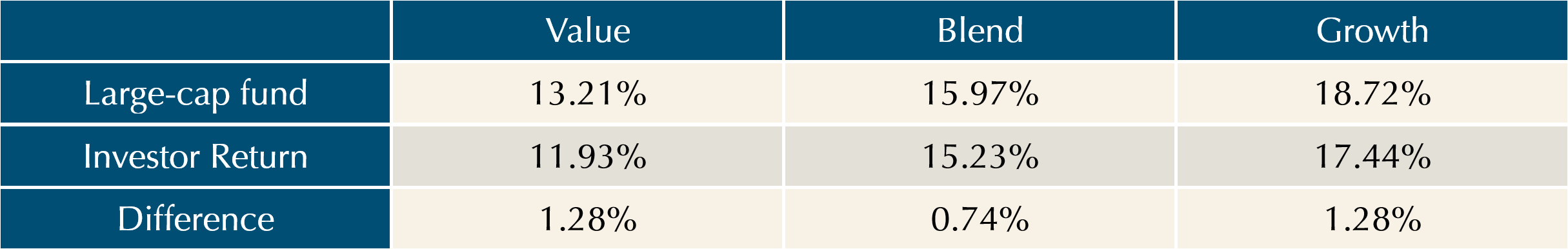

Unfortunately, while the head may understand this, the heart does not. If you look at Table 13, across different kind of funds, there is a difference between fund returns and what the investor is actually getting. The key reason can be attributed to investors not staying invested through their investment horizon and getting in and out at the wrong times. As such, although the funds are producing the returns, they did not stay long enough to reap them.

Table 13: Investors’ returns vs funds’ returns, 10 years ended 31 Dec 2021 | Data source: Morning Star, Inc.

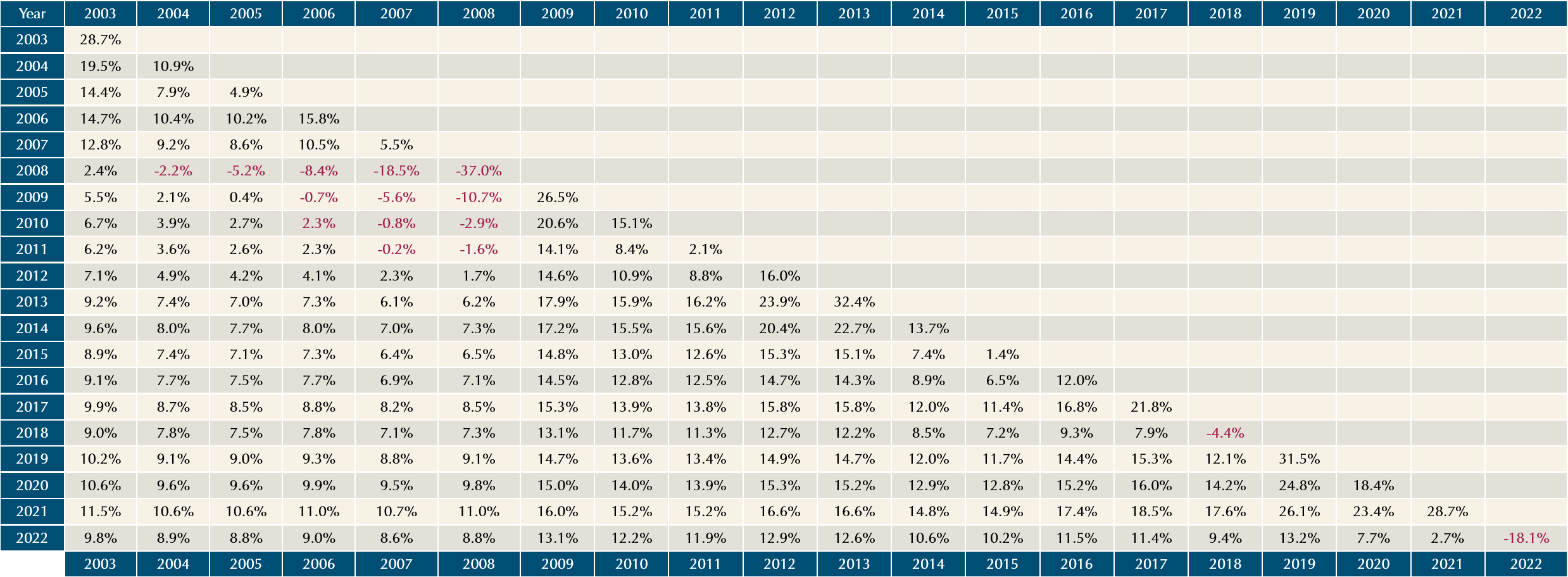

But does staying invested over the long run without timing the markets really give the retirees the returns? If you look at Table 14, we can observe the following:

- If you invested over the past 20 years, there are many short holding periods where you would have had negative annualized returns.

- But if you stayed invested, even if you had started investing in the worst years, you would have eventually gotten positive annualized returns over the long term.

Space does not allow me to show you that these observations are the same, even if we stretch the Table from 1928 to 2016, almost a century worth of data.

Table 14: Annualised returns of S&P500 from 2003 – 2022 | Data source: Dimensional

(How to read this Table: If you had invested into the S&P500 in 2003, your annualised return for that 1 year would have been 28.7%. If you stayed invested till 2023, your annualised return for the 20 years would have been 9.8% p.a.)

Is it possible to do better if you time the markets, get out before a crisis hits and get in just before recovery? Of course! But it would be extremely difficult to do and even professional managers do not get it right most of the time.

Imagine that you could guess when to get in and out of the market with 70% accuracy (although, in reality, it would be a lot lower than this!). If you take a single instance of having to find the right exit point and then a good re-entry point, your chance of getting the pair of decisions exactly right would be 70% multiplied by 70% which is only 49%—worse than simple luck or the flip of a coin. Now, imagine having to take that risk repeatedly across the entirely of your investment lifetime.

The Right Mindset, Right Portfolio and Right Adviser

These observations not only confirm that it is better to remain invested over the long haul, but that something must be done to help retirees align what they know with how their hearts feel. This is where advisers truly can add value by:

- Creating suitable asset allocation

- Rebalancing the portfolio regularly to keep the portfolio at the right risk level

- Coaching their clients so that they do not make costly mistakes

- Implementing the portfolios in a cost-effective manner

- Planning their clients’ retirement withdrawals properly (having a spending strategy)

The first three helps retirees stay invested by always ensuring that they are invested into portfolios that are suitable for their risk appetite. This requires a deep understanding on retirees’ retirement aspirations, required rate of return, financial situation, personal situation as well as their preference for taking a certain level of risk. This understanding further allows regular behavioural coaching to take place so that retirees will stay invested even in the worst of times.

Using low-cost instruments can enhance returns (we will talk about this later).

Executing an appropriate spending strategy allows retirees to have their money ready when they need it.

The RetireWell™ methodology which we discuss in this book is all about this.

Some call this the Adviser’s Alpha. According to research by Vanguard, one of the largest fund managers in the world, the total potential value of this can be as high as 3% of the net returns you get from your investments.

The writer, Christopher Tan, is Chief Executive Officer of Providend, Southeast Asia’s first fee-only wealth advisory firm and author of the book “Money Wisdom: Simple Truths for Financial Wellness”.

The edited version has been published in The Business Times on 29 April 2017.

Here are the links to the RetireWell™ eBook chapters:

- Part 1: Drawing Down Retirement Money

- Part 2: A Tale of Two Retirees and Their Fortunes

- Part 3: Ensuring a “Safe Retirement Income Floor”

- Part 5: Stock Markets Always Rise Over the Long Term

- Part 6: Setting Aside Adequate Additional Buffers

- Part 7: Capturing Returns Effectively

- Epilogue 1: Purpose-Driven Retirement Planning

- Epilogue 2: Retirement – It’s About the Kind of Life You Want to Lead

Being a trusted adviser to our affluent clients for over two decades, we know that our clients need the reliability and sufficiency of investment returns to meet their needs. You can learn more about our purpose-driven approach towards Wealth Management and Investment Management.

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.