The last month has been a crazy time for those of us who are invested in the equities market. The US market went up 10% in one day and then came down 12% on another. On the day when it came down 12%, it was the biggest fall in one day since 1987. And at this point of writing, the S&P500 was up 9.4% last night, the biggest one-day gain since 2008! But despite the huge gain, the S&P500 has fallen about 26% from its peak.

So, it has been a busy time for us at Providend as we spent time engaging clients, explaining to them what has happened to the markets and what the governments around the world have been doing to prevent an economic crisis to become a financial one. We wrote emails after emails, produced and re-produced articles and videos, and also text all of our clients to assure them that this pandemic will pass, and the markets will recover again. Where necessary, we met up with clients and through their retirement and investment plan, show them that they need to stay invested to get the returns they need and that they have the ability to do so even though they may feel a bit nervy today. The message from us was clear: Don’t be affected by news headlines. Stay invested and keep investing for the long term.

Then as I was surfing the various platforms on social media, I realized that almost everyone, from investors to advisers were sending the same message. And that got me a bit worried. Why so? Let me explain.

Why did we coach our clients to stay invested?

To explain why, allow me to share an extract from one of Providend’s recent market update to clients.

“If you cut out all the noise from the various headlines, the key issue is that the efforts to contain and mitigate the COVID-19 pandemic are likely to lead to a global recession by affecting both supply and demand of products. On the supply side, as countries affected enact measures to enhance social distancing, the effect is to close manufacturing and retail across the globe. Apple has shut its retail stores outside of Greater China. Bars, restaurants and malls across Europe and America are closed. Air travel and tourism across the world is almost entirely halted. European car manufacturers are closing factories as they are running out of critical parts, not to mention that their workforce is also unable to work effectively due to all the social distancing measures in place. On the demand side, many workers might be forced into unpaid leave (the airline industry is a prime example currently) or reduced hours, reducing their income and thus reducing the demand for goods and services. These are but some examples of the economic disruption being faced across the world.”

Stock markets are falling because there is now great uncertainty in companies’ future earnings due to the economic impact, as businesses are not able to generate earnings due to both a lack of supply and demand. While stock prices look to the price in the impact on future earnings, the uncertainty caused by situations that have been evolving fluidly can cause panic which sometimes may not be rational. This adds to the volatility of the stock market which we have seen in recent weeks.

If you have been following the headlines in media, central banks have been acting to prevent an economic crisis from becoming a financial one. The Fed has cut interest rates to 0, restarted its quantitative easing program and this time there are no limits to the number of bonds the Fed can buy. Critically, the Fed has also reopened the swap lines last used in 2008 to fund other central banks such as the ECB, BoJ, BoE, SNB and MAS with USD at cheap rates, to ensure that the rest of the world does not run out of the reserve currency. The ECB has offered loans to banks at -0.75% interest and has committed to buying 120 billion Euro more of bonds during periods of volatility. The BoJ has doubled its limit of ETFs and REITs, purchase 1 trillion Yen more of corporate bonds and commercial paper and start a lending program for commercial banks worth 8 trillion Yen.

All these actions by the central banks are to support the stability of the financial system and financial markets, to ensure that markets continue to function during this period of economic stress. So even as you read the news, know that there are swift actions taken by the central banks to prevent a financial crisis. But do also understand that, just like medical treatment will take some time for the body to respond to it, the markets will also take some time to recover and when they do, they recover strongly.

As we have mentioned previously, as long as the financial system remains stable, the economy will bounce back when the COVID-19 pandemic ends. While there is no certainty how long it will take for the virus to run its course, eventually the world will get back on its feet, and people will go back to economically productive activities, and companies will start to get more certainty on their future cash flows again. This will allow markets to start pricing stocks with more confidence as well.

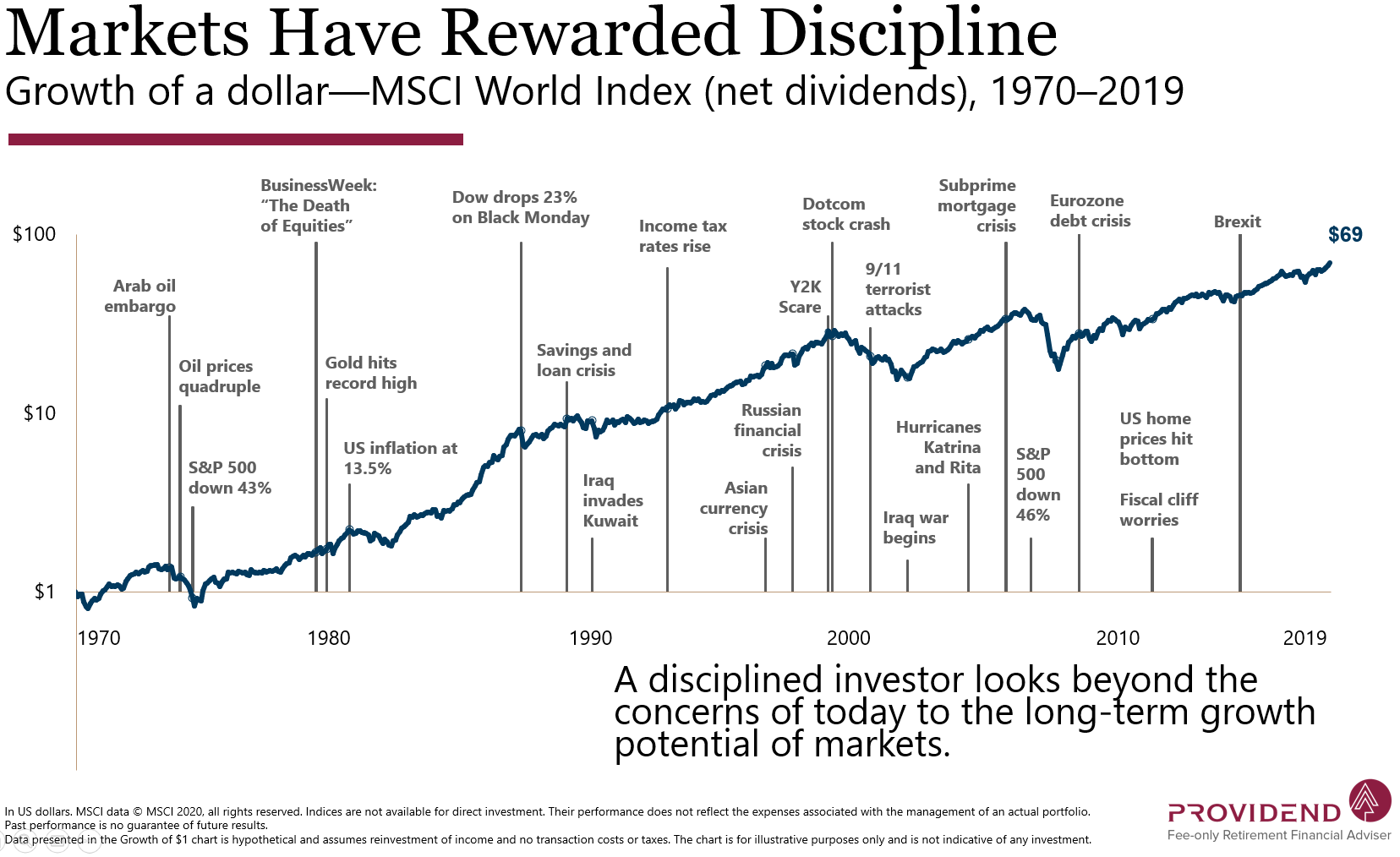

Chart 1

As we can see from Chart 1 above, staying invested through the various crises helps you capture the returns from the stock market. The world has come through various challenges before, and it is likely to do so again this time. Most importantly, you want your portfolio to be positioned to benefit from it by being invested in the markets when the recovery happens. When that happens, as we have mentioned repeatedly in our previous notes to you, it is usually a big rebound as we can see from the data in Chart 2 below.

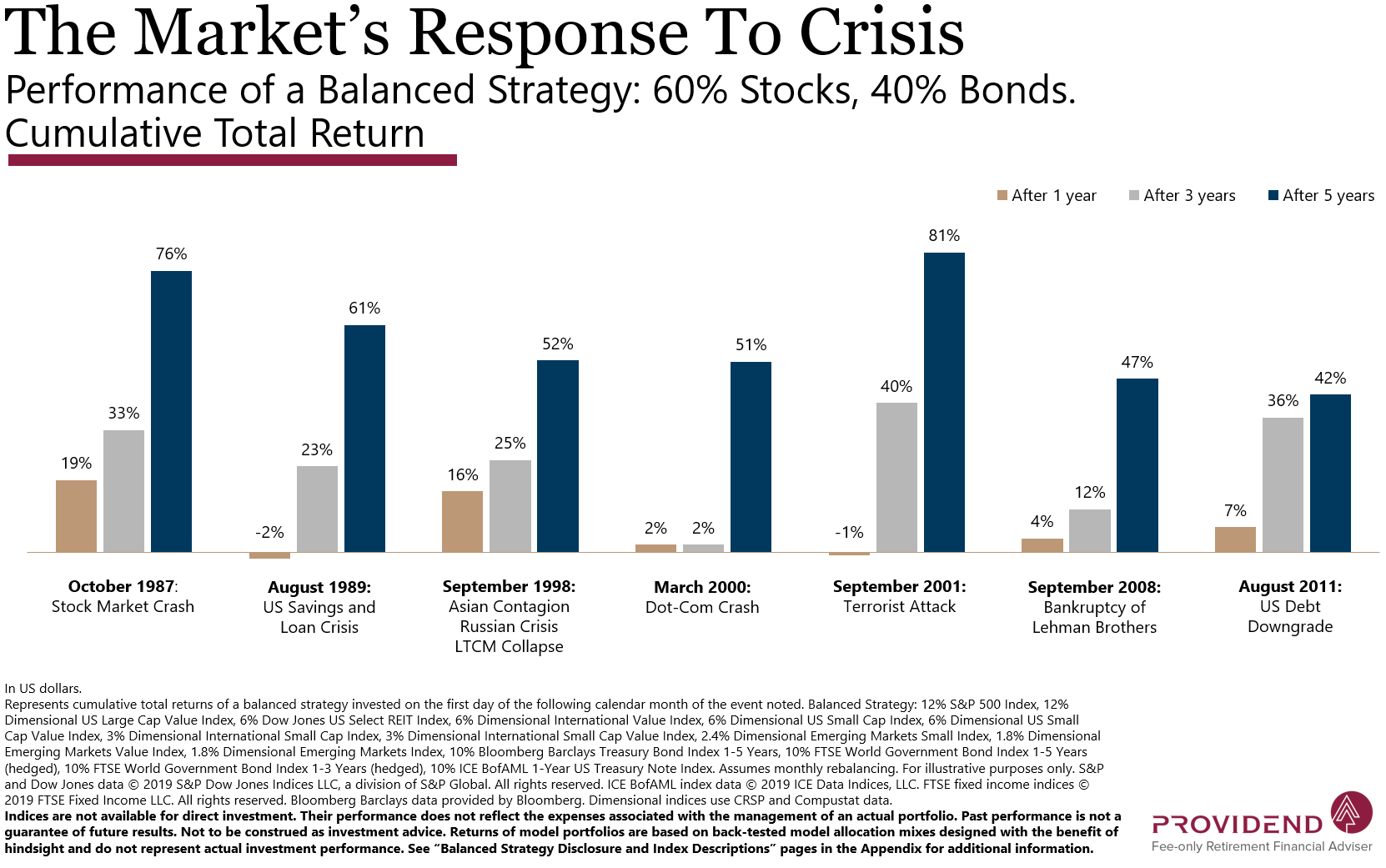

Chart 2

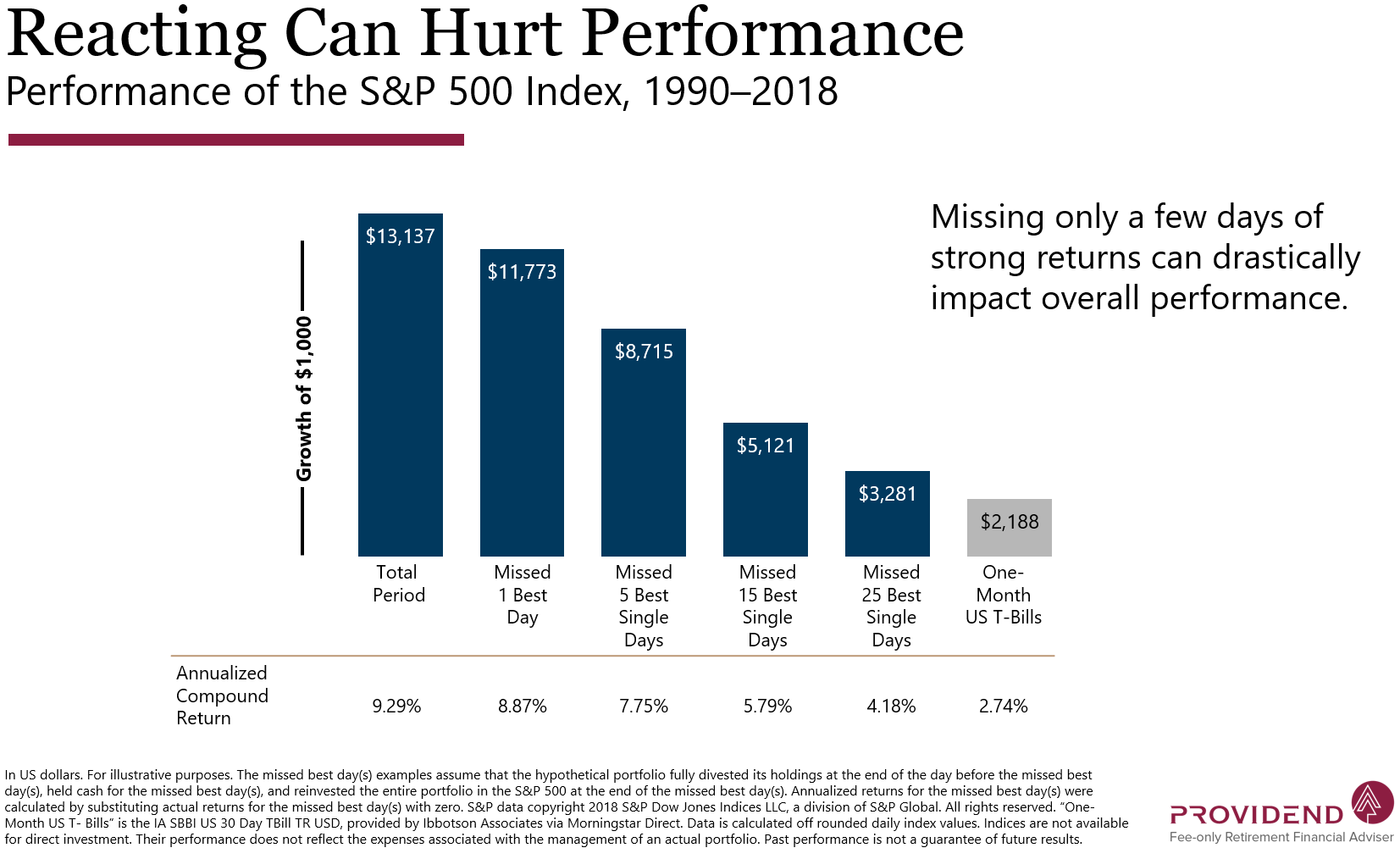

Some may ask why not wait for the markets to go down rock bottom and only enter the markets when they show signs of recovery. The problem with this approach is that nobody knows with certainty when that exactly will happen and once we miss the initial recovery, we missed a lot of the returns.”

Chart 3

For Providend and me, we have gone through many market crashes and the biggest one being the 2008 GFC. Even that has passed and we saw how the US market has recovered strongly since then.

But here is the thing: You noticed that the charts we used (and for that matter, most people used to encourage us to stay invested) are indices. You can’t invest directly into an index, but you can do it either via an index fund or an ETF, such as those from Vanguard, SPDR etc. Alternately, you can invest in the markets via market-based funds such as those from Dimensional Fund Advisors.

And when you invest using an index fund, ETFs or market-based funds:

- You are invested in a huge diversified portfolio of securities and not just a few.

- You always stay invested as these funds do not attempt to move in and out from markets because that is not their mandate. Their mandate is to remain invested in the market at all times!

So, what do all these means?

- These means that if you are only invested in a few securities whether they be stocks or bonds, you should not just listen to anyone to stay invested and keep investing without knowing whether the companies that you are investing and remain invested in may go bust. There is a real possibility you can lose a lot of or all your capital because you are so concentrated.

- These also means that if you are invested in actively managed funds and not index funds or a market-based funds, the whole idea of staying invested so that when the recovery happens, you can capture the strong returns may not work for you. This is because there is a real possibility that while you remain invested in these funds, the fund manager has already “de-risk” the portfolio and sold part of the equities to cash in order to minimize the loss or hold cash to try and time his entry once he thinks markets have bottomed. Also, it is possible for a bond fund, such as a global bond fund with a very broad mandate to be buying into lower-quality bonds that may give higher yields during the good time but tank during times like this. We are already seeing a lot of stress in the bond market, especially in the high yield bond segment.

In 2008, the above was exactly what happened. While investors were told to not panic, remain invested and don’t time the market, active managers were selling to cash to minimize losses. And when the recovery started after March 2009, it caught many of them by surprise. Also, at that time, there was a global bond fund in Singapore that was falling in prices by the day. When they were asked to show the securities they were holding, it was shocking to find out that many of the bonds they bought were lower quality ones and eventually, this fund went belly up. So is this still happening today? In an article dated 9 March 2020, Financial Planning Magazine reported:

“After a decade-long uphill battle against passive investing, active funds are getting a rare moment of respite, courtesy of the worst equity sell-off since 2018.

About 60% of large-cap mutual funds beat their benchmarks as the S&P 500 tumbled into a correction in February, the best hit rate in two years, according to data compiled by Bank of America. The outperformance was achieved when the average fund only fell 7.8% over the stretch in question.

This is what life has become for active managers, trying to sell something whose main claim to value is that it fails at a slightly less horrifying rate when shares tumble. That’s how it sometimes seems, going by the last few stock routs: long-only mutual funds are mainly good at beating benchmarks in down markets while trailing when things are going up.

“It’s frustrating,” said Jeff Sica, chief investment officer of Circle Squared Alternative Investments in Morristown, New Jersey. “The angst of most active managers is that their only time to shine seems to be where the market is collapsing.”

Sica said fund managers have been able to weather the market storm partly because they quickly cut risk. Theoretically, raising cash or trimming big losers would allow a portfolio to avoid deeper losses. During the latest sell-off, money managers have been selling stocks at the fastest pace since 2014, according to a survey by the National Association of Active Investment Managers.”

So it seems that it is the same today, while you may believe in staying invested for the long term, the active managers that you are invested in are selling their positions to raise cash and cut risk so that they “fail at a slightly less horrifying rate when shares tumble”. And if they fail to go back to the market in time, you are going to be let down when the market recovers. And chances are, you will be let down as evidence has shown that most active managers do not do better than the market in the long run. For those that do, they do not do it consistently.

So, if you are invested in a few individual securities and/or actively managed funds, do not just follow the advice of “staying invested” blindly. Before you do so:

- Please check your individual stocks and bonds that you are holding to, whether they are worth holding on for the long term.

- Please check the funds that you are invested in, if they are actively-managed funds, you may not fully be invested even if you did not sell down and when the markets recover and they will, you might not participate in the recovery because your managers are partly in cash. You may wish to check if your funds have done that.

- If you are invested in a bond fund, you might want to check what these funds are invested in. Not all bond funds are the same and not all survive in a market crash.

Every week, I go to the gym to work out with a trainer to keep myself fit. He pushes me to the maximum so that I can improve. But he can do so only because he knows my limit, my medical background and health condition. He will not push me beyond what my health can take. In the same manner, when Providend asked our clients to stay invested, it is not just because we use instruments that ensure that our clients are always fully invested, it is also because we have spent about 30 hours of initial work to know our client’s financial ability to do so. To push our clients to stay invested in this very volatile period without knowing their ability to do so will be sheer irresponsibility.

So the next time when you hear this advice “stay invested for the long term”, do consider the instruments that you are invested in and see if you are really staying invested or should stay invested in. In addition, do ask yourself if you currently have the ability to stay invested for the long term. If you have a well thought out plan before you invested your money, you probably would be able to weather the storm. But if you are unable to, you probably should do something about your situation before it is too late.

The writer, Christopher Tan, is Chief Executive Officer of Providend, a Fee-only Wealth Advisory Firm. Besides being financially trained, he is also an Accredited Certified Coach with the International Coach Federation.

For more related resources, check out:

1. Elements Of Wealth And How It Is Built | Investment Series

2. To Do Well In Investments, Don’t Focus Too Much On Forecasts

3. Lump Sum vs Dollar Cost Averaging Strategy

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.