One of the values that Providend help our clients with is to help them make sense of a very complicated world.

The idea is that prospects or clients who subscribe in some ways to the mainstream media will get exposed to a lot of information about the markets. In times like this, a lot of this information can be depressing.

What these do to you is that it makes you feel that there is “something” you need to act upon. You either need to re-allocate your portfolio, buy some undervalued stocks or sell to protect your capital.

Some of these information matters. Some not so much. A lot of times, we interpret a piece of information differently.

We try to coach our clients over the years, to sieve out what they need to pay attention to and what does not make any impact on their wealth.

With that, clients are less panicky with their investments. This allows them a greater chance to capture more of the returns expectations.

Dan Egan’s research in this area seems to tell us that the individual investor, often accused of making irrational decisions may be much maligned.

Dan works as the Director of Behaviour and Investing at Betterment, one of the biggest Roboadviser in the United States. Before that he used to work as a Behavioural specialist for Barclay’s Wealth.

Dan’s was able to gain access to the database of one of UK largest self-directed broker (likely Barclays), and tap upon the data at Betterment. His research also brings him to data on Vanguard investors’ behaviour.

Most People Just Do Nothing With their Investments

In general, the individual investor is less panicky than we think. During market drawdowns (when equity prices viciously move down), they participate in less board based selling.

Dan’s work in the UK shows that self-directed traders tend to buy on the dips and let their cash accumulate after rallies.

On average they do what a good wealth builder would do: They bought relatively low and sell relatively high. Of course, there are the odd ones who market time, have trades that blow up spectacularly.

Dan could not reveal some of the data he came across in his work (probably due to privacy reasons) but he estimated that most of us do nothing during periods like these.

In a study of Vanguard IRA accounts from 2008 to 2013, 1 in 5 accounts have absolutely zero activity during the period. (IRA accounts are the equivalent to our Supplementary Retirement Scheme SRS accounts). This means there were no deposits, withdrawals, purchases, exchanges.

Why don’t we do anything with our Investments?

Dan believes that most of us do not like to dabble in such things. For most of the accounts that are equivalent to SRS accounts, we have set automatic investments and re-investment to them.

Our Response to Panic Usually Spreads Over a Spectrum

The impact of our actions on our investment portfolios most likely varies. Some of our actions in our portfolio will bring about better performance. Sometimes it will make returns worse.

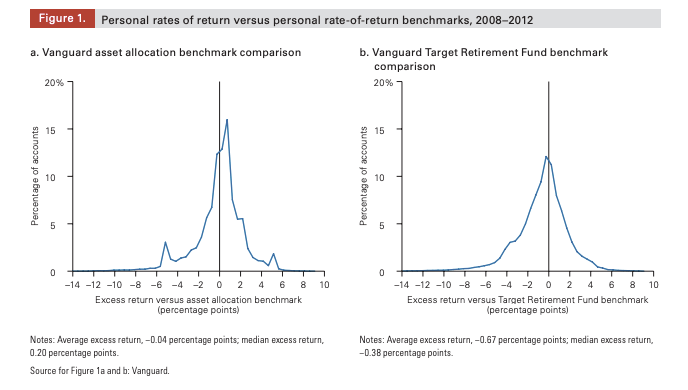

The two charts above show the excess return of Vanguard investors’ portfolio over their asset allocation benchmark. The right chart is different from the left chart in that they are target retirement funds, which are lifecycle funds that allocate based on an investors horizon towards retirement.

So a 2% excess return means that a 60/40 Vanguard allocation portfolio earns 5% over the period and some investors were able to earn 7% over the same period.

We noticed that in general most of the performance are close to the asset allocation benchmarks. This would mean that whether you act upon, or do not act upon news in the market, or choose to do nothing, the actions and inactions might not matter so much.

However, there will be those that will outperform and underperform.

The Ramifications of Panic Selling & the Art of Doing Nothing

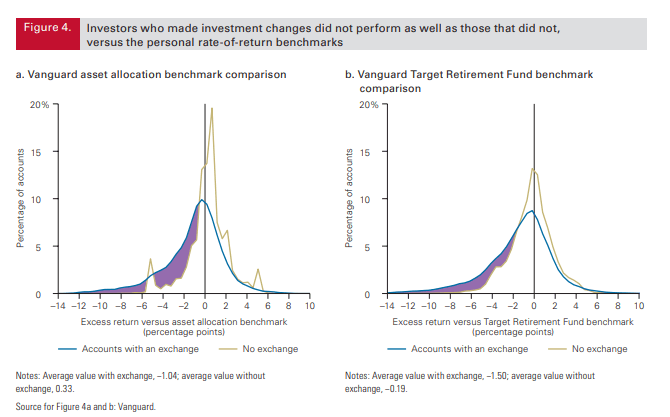

Within the same Vanguard research, they also observed that for those who act upon their portfolio and underperform, their underperformance tends to be greater than those who did better due to their actions.

The bell shape charts are similar to the two bell-shaped curves in the previous section. This time, Vanguard split out those who did an exchange (meaning switch from existing to something else).

In general, those with no exchange did better, whether they gain positive or negative excess returns (the brown line is in front of the blue line)

The average investor who made one exchange over the entire five-year period trailed the Vanguard asset allocation benchmark by 1.04%.

Dan and I also read something out of this: If you are prone to panic, over a medium-term period, you may underperform versus if you do not do anything.

You might need someone to enlighten you during testy situations like these, or basically to pull you off the financial ledge.

The Final Word

Like Dan, through my work at Providend, and the interaction with readers at Investment Moats, I have a sensing that for most, their individual portfolio tends to be more of a fire-and-forget portfolio.

The activity on their investment is far less than we imagine.

Having less activity can be a doubled-edge sword.

In order to capture the return, you need to let your investments sit so that your investments can capture the population growth, productivity growth and the corporate growth of the companies in your investments.

Yet, if you have a portfolio of individual stocks, you would need to recognize that a portfolio that compounds require you to prune away stocks where your original thesis didn’t pan out, after giving them enough time to show what the management can do. It also requires you to add on to stocks where the management validates what they say with actual profits and shareholder returns.

Active Investing is a full-time job in itself.

If the context of the discussion is not on a portfolio of individual stocks but a global stocks and bond fund, then most of the time sitting and doing nothing works better.

We have seen clients who held on to active funds for 15 years get some returns. They might have picked the wrong funds, the funds might have wrap and fund cost, but their wealth does still grow over time (although the opportunity to do better with lower-cost options exists!)

Sitting through market volatility and an avalanche of news data points can be tough. We always wish that we NEED to do something.

The value of an adviser is to ensure that you capture the returns. A fund can perform very well (10% a year) but the investor only manages to get a lower return (-2% a year) because they could not sit on investment to capture the returns.

There is a lot of value in the hard conversations, risk coaching that advisers do. The challenging thing, in my opinion, is that investor’s seldom see value there and therefore question why they need to pay for it.

The value and the cost of not paying, unfortunately, can only be known 7 to 10 years down the road.

The article you have just read is part of Providend Curated Insights, a selected repository of content that we research about and reflect upon for the best recommendations to our clients.

Providend Curated Insights is narrated currently by Kyith Ng, Senior Solutions Specialist at Providend, Singapore’s First Fee-only Wealth Advisory Firm, and Chief Editor of InvestmentMoats, Singapore’s most well-read financial blog.

For more related resources, check out:

1. Stay Invested for The Long Term? Think Again!

2. Returns of a Portfolio of World Equities Through Good Times and Bad Times

3. The Importance of Liquidity in Your Investment Portfolio

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.